A Guide to Closed-End Funds

CONTENTS

What Is a Closed-End Fund?

Features of Closed-End Funds

Total Assets of Closed-End Funds

Sources of Closed-End Fund Information

Pricing

Investment Return

Taxes

Regulation and Disclosure

Fees and Expenses

Buying and Selling Shares

Shareholder Information

For More Information

This guide includes an overview of the types of closed-end funds and how they operate. However, each closed-end fund is different, and investors should learn more about a particular fund before investing. Closed-end funds—like all investments—involve risk, including the possible loss of principal.

What Is a Closed-End Fund?

Closed-end funds are one of four types of investment companies registered under the Investment Company Act of 1940, along with mutual funds, exchange-traded funds, and unit investment trusts. Closed-end funds generally issue a fixed number of shares that are listed on a stock exchange or trade in the over-the-counter market. The assets of a closed-end fund are professionally managed in accordance with the fund’s investment objectives and policies, and may be invested in stocks, bonds, and other assets. The market price of closed-end fund shares fluctuates like that of other publicly traded securities and is determined by supply and demand in the marketplace.

Interval funds represent a subset of closed-end funds. These funds, under Rule 415 and Rule 486 under the Securities Act of 1933 and Rule 23c-3 under the Investment Company Act of 1940, may continuously offer their shares and make offers to repurchase shares at net asset value (NAV) at periodic intervals. For more information on how they operate, see Interval Funds: Operational Challenges and the Industry’s Way Forward and Consider This: Interval Fund Operational Practices.

Features of Closed-End Funds

A closed-end fund is created by issuing a fixed number of common shares to investors during an initial public offering (IPO). Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestments. Closed-end funds also are permitted to issue one class of preferred shares in addition to common shares. Holders of preferred shares are paid dividends, but do not participate in the gains and losses on the fund’s investments. Issuing preferred shares allows a closed-end fund to raise additional capital, which it can use to purchase more assets for its portfolio.

Once issued, shares of a closed-end fund generally are bought and sold by investors in the open market and are not purchased or redeemed directly by the fund—although some closed-end funds may adopt stock repurchase programs or periodically tender for shares. Because a closed-end fund does not need to maintain cash reserves or sell securities to meet redemptions, the fund has the flexibility to invest in less-liquid portfolio securities. For example, a closed-end fund may invest in securities of very small companies, municipal bonds that are not widely traded, or securities traded in countries that do not have fully developed securities markets.

Closed-end funds have the ability, subject to strict regulatory limits, to use leverage as part of their investment strategy. The use of leverage by a closed-end fund can allow it to achieve higher long-term returns, but also increases risk and the likelihood of share price volatility.

Total Assets of Closed-End Funds

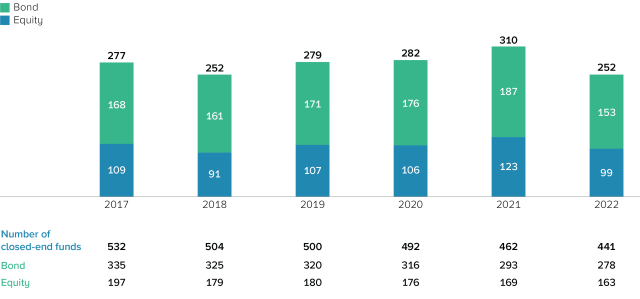

At year-end 2022, 441 closed-end funds had total assets of $252 billion.

Total Assets of Closed-End Funds Declined in 2022

Billions of dollars, year-end

Note: Total assets is the fair value of assets held in closed-end fund portfolios funded by common and preferred shares less any liabilities (not including liabilities attributed to preferred shares).

Source: ICI Research Perspective, “The Closed-End Fund Market, 2022” (forthcoming)

Bond Closed-End Funds

Historically, bond funds have accounted for a large share of assets in closed-end funds; and at year-end 2022, total assets in bond closed-end funds were $153 billion, or 61 percent of closed-end fund assets.

All bond closed-end funds are subject to some degree of market risk and credit risk. Market risk is the risk that interest rates will rise, lowering the value of bonds held in the fund’s portfolio. Generally speaking, the longer the remaining maturity of a fund’s portfolio securities, the greater the volatility of its NAV due to market risk. Credit risk is the risk that issuers of bonds held by the fund will default on their promise to pay principal and interest. A bond closed-end fund’s investment policies typically define the credit quality and maturity of the investments the fund may make.

Equity Closed-End Funds

At year-end 2022, total assets in equity closed-end funds were $99 billion, or 39 percent of closed-end fund total assets.

All equity closed-end funds are subject to the risk that the portfolio securities held by the fund will decline in value, thus causing a decline in the fund’s NAV and market price. The value of a particular stock in a fund’s portfolio may increase or decrease for a variety of reasons, including the business activities and financial condition of the issuer of the stock, market and economic conditions affecting the issuer’s business, or the stock market generally.

Sources of Closed-End Fund Information

Information on closed-end funds, including NAVs, market prices, and discounts or premiums, can be found in stock market tables on most major financial websites. Some stock market tables offer other information, including a closed-end fund’s high and low market prices for the past 52 weeks; distributions paid to shareholders during the past 12 months; and the high, low, and closing market prices for the previous day.

Other sources of information about closed-end funds include the financial press and the fund sponsor. Many closed-end fund sponsors have personnel available to answer questions about the fund and to provide written information. In addition, periodic reports, proxy statements, and, in some cases, fund registration statements, can be found on the website of the Securities and Exchange Commission (SEC) at www.sec.gov.

Pricing

More than 95 percent of exchange-listed closed-end funds calculate the value of their portfolios every business day, while others calculate their portfolio values weekly or on some other basis. The NAV of a closed-end fund is calculated by subtracting the fund’s liabilities (e.g., fund expenses) from the current market value of its assets and dividing by the total number of shares outstanding. The NAV changes as the total value of the underlying portfolio securities rises or falls, or the fund’s liabilities change.

Because an exchange-listed closed-end fund’s shares trade in the stock market based on investor demand, the fund may trade at a price higher or lower than its NAV. A closed-end fund trading at a share price higher than its NAV is said to be trading at a “premium” to the NAV, while a closed-end fund trading at a share price lower than its NAV is said to be trading at a “discount.” Funds may trade at discounts or premiums to their NAVs based on market perceptions or investor sentiment. For example, a closed-end fund that invests in securities that are anticipated to generate above-average future returns and are difficult for retail investors to obtain directly may trade at a premium because of a high level of market interest. In contrast, a closed-end fund with large unrealized capital gains may trade at a discount because investors will have priced in any perceived tax liability.

Fund management may take measures in an attempt to reduce discounts, including increasing market visibility of the fund through public reports and communications. A closed-end fund also may attempt to increase the demand for its shares by offering a dividend reinvestment plan, engaging in tender offers (the fund offers to purchase its shares directly from shareholders at, or close to, NAV), or instituting a stock purchase program (the fund purchases its shares on the open market). Further, some closed-end funds periodically may consider converting to either an open-end fund or an exchange-traded fund, which would permit shareholders to redeem their shares at NAV.

Of course, any such measures must be approved by the fund’s board of directors as consistent with the best interests of the fund.

Investment Return

A closed-end fund’s investment return has two primary components:

- Share price appreciation or depreciation: A closed-end fund’s share price may increase or decrease based on market perceptions about the types of securities or geographic region in which the fund invests and perceptions about the fund or its investment manager.

- Distributions: A closed-end fund makes up to three types of distributions to shareholders: ordinary dividends, capital gains, and return of capital. Some closed-end funds follow a managed distribution policy, which allows them to provide predictable, but not guaranteed, cash flow to common shareholders. The payment from a fund pursuant to a managed distribution policy is typically paid to common shareholders on a monthly or quarterly basis. Managed distribution policies are used most often in multi-strategy or equity-based closed-end funds.

- Ordinary dividends: A closed-end fund earns interest and dividend income from securities held in its portfolio. This income, minus fund operating costs, typically is paid to shareholders as ordinary dividend distributions.

- Capital gains: If a fund profits from selling securities during a calendar year, the fund may distribute the gains to investors. Distributions of capital gains typically occur annually near the end of the calendar year. Some funds, particularly those with managed distribution plans, distribute capital gains more frequently.

- Return of capital: A closed-end fund may return capital back to shareholders. Return of capital may occur in a variety of circumstances, including when a fund is acting as a pass-through. In that circumstance, one or more of its underlying holdings had a return of capital (usually true for master limited partnerships) and the closed-end fund is merely passing this payment through to its shareholders. In other circumstances, a closed-end fund with a managed distribution policy may return capital to maintain a stable regular distribution that, over the long term, matches the fund’s distributions to its total return.

Taxes

In order to avoid the imposition of federal tax at the fund level, a closed-end fund must meet Internal Revenue Service (IRS) requirements for sources of income and diversification of portfolio holdings, and must distribute substantially all of its income and capital gains to shareholders annually.

Generally, shareholders of closed-end funds must pay income taxes on the income and capital gains distributed to them. Each closed-end fund will provide an IRS Form 1099 to its shareholders annually that summarizes the fund’s distributions. When a shareholder sells shares of a closed-end fund, the shareholder may realize either a taxable gain or a loss.

Regulation and Disclosure

Closed-end funds are regulated under federal laws designed to protect investors. The Investment Company Act of 1940 requires all funds to register with the SEC to meet certain operating standards and to deliver information to investors; the Securities Act of 1933 requires registration of the fund’s shares and the delivery of a prospectus to investors who purchase shares in the IPO; and the Securities Exchange Act of 1934 regulates the secondary market trading of the fund’s shares and establishes antifraud standards governing such trading. Finally, the Investment Advisers Act of 1940 regulates the conduct of fund investment managers and requires them to register with the SEC.

All US-registered closed-end funds are subject to stringent laws and oversight by the SEC and the exchanges on which their shares are listed. All funds must provide a written prospectus containing complete disclosure about the fund when its shares are initially offered to the public. Following the IPO, other disclosure documents, including the annual and semiannual reports and the proxy statement, provide information to investors.

The SEC conducts inspections of fund operations to determine compliance with applicable laws and SEC regulations. Stock exchanges on which a fund’s shares are listed also impose certain requirements. Stock exchanges require the prompt public disclosure of material information and require certain corporate governance and management procedures, including annual shareholder meetings.

Fees and Expenses

A closed-end fund incurs operating expenses, including those associated with fund portfolio management, fund business operations, custody of the fund’s assets, and shareholder services. These operating expenses are paid by the fund from its assets before any distributions are made to investors. A fund’s expenses are summarized in a fee table included in the fund’s prospectus. Updated expense information is provided in a fund’s semiannual and annual reports to shareholders.

Buying and Selling Shares

Closed-end fund shares are bought and sold in the same way one would buy corporate stocks—through registered broker-dealers.

During the IPO, a fixed number of closed-end fund shares are offered to investors. After the IPO, an investor may purchase shares of existing closed-end funds in the secondary market.

In an IPO, a closed-end fund’s shares typically are sold subject to a sales charge that is paid to the underwriter and the broker-dealer who sells the shares. A closed-end fund investor buying or selling shares in the secondary market likely will pay a sales commission to a broker at the time of the transaction. The purchase or sale price for shares reflects the current market price, adjusted for the brokerage commission.

Shareholder Information

The annual and semiannual reports that closed-end funds provide to shareholders contain financial statements and information on the fund’s portfolio, performance, and investment goals and policies. A fund’s annual report contains financial statements that have been audited by the fund’s independent public accountants and management’s discussion of fund operations, investment results, and strategies. In addition, a fund or an investor’s broker may provide statements that update and summarize individual account holdings and values.

For More Information

- “The Closed-End Fund Market, 2021,” ICI Research Perspective

- Frequently Asked Questions About Closed-End Funds and Their Use of Leverage

- Find quarterly updates to closed-end fund asset data at www.ici.org/research/stats/closedend

April 2023