News Release

EBRI/ICI Study Shows Significant Growth in Account Balances for Younger 401(k) Plan Participants Who Consistently Participate

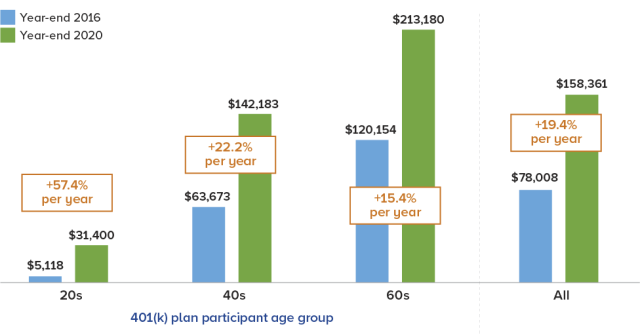

Washington, DC; March 23, 2023—Account balances for consistent 401(k) plan participants rose from year-end 2016 through year-end 2020, according to a new study from the Employee Benefit Research Institute (EBRI) and the Investment Company Institute (ICI) titled “What Does Consistent Participation in 401(k) Plans Generate? Changes in 401(k) Plan Account Balances, 2016–2020.” The average 401(k) plan account balance for consistent participants rose each year from year-end 2016 through year-end 2020. Overall, increases reflect a compound annual average growth rate of 19.4 percent over the period, with the average account balance rising from $78,008 at year-end 2016 to $158,361 at year-end 2020.

Younger 401(k) participants, or those with smaller year-end 2016 balances, experienced higher growth in account balances compared with older participants, who tend to have larger balances on average. Three primary factors affect account balances: contributions by the participant, employer, or both; investment returns; and withdrawal and loan activity. The percent change in balance for participants in younger age groups was influenced by the relative size of their contributions to their account balances.

“Exploring the changes in account balances among consistent 401(k) plan participants highlights the strength of the 401(k) plan as a powerful savings tool,” said Sarah Holden, ICI Senior Director of Retirement and Investor Research. “Younger 401(k) plan participants, whose relatively smaller initial account balances benefited from contributions as well as market returns, saw the highest growth rates over the period as their average 401(k) account balance rose 57.4 percent per year, on average, over the period.

Changes in 401(k) Plan Account Balances Among Consistent 401(k) Participants

Average 401(k) plan account balance and percent change compound annual average growth rate 2016–2020

Note: The sample is 3.7 million consistent participants in the EBRI/ICI 401(k) database over the four-year period from year-end 2016 to year-end 2020. Age group is based on participant age at year-end 2020. Account balances are participant account balances held in 401(k) plans at the participants' current employers and are net of plan loans. Retirement savings held in plans at previous employers or rolled over into IRAs are not included.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

Key findings in the report include:

- The median 401(k) plan account balance for consistent participants increased at a compound annual average growth rate of 28.3 percent over the period, to $62,134 at year-end 2020.

- Younger 401(k) participants or those with smaller year-end 2016 balances experienced higher percent growth in account balances compared with older participants or those with larger year-end 2016 balances. Because younger participants’ account balances tended to be smaller, their contributions produced significant percentage growth in their account balances.

- 401(k) participants tend to concentrate their accounts in equity securities. On average at year-end 2020, more than two-thirds of consistent 401(k) participants’ assets were invested in equities—through equity funds, the equity portion of target date funds, the equity portion of non–target date balanced funds, or company stock. Younger 401(k) participants tend to have higher concentrations in equities than older 401(k) participants.

“Younger 401(k) plan participants tended to be more invested in equity funds and target date funds while older participants were more likely to invest in fixed-income securities,” said Craig Copeland, EBRI Director of Wealth Benefits Research. “At year-end 2020, 401(k) plan participants in their twenties had allocated 86 percent of their plan account balances to equities while participants in their sixties had allocated 57 percent to equities.”

About the Study

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans, compiled through a collaborative research project undertaken by the two organizations since 1996. The project is unique because it includes data provided by a wide variety of plan recordkeepers and, therefore, represents the activity of participants in 401(k) plans of varying sizes—from very large corporations to small businesses—with a variety of investment options. This longitudinal analysis tracks the account balances of 3.7 million 401(k) plan participants who had accounts in the year-end 2016 EBRI/ICI 401(k) database and each subsequent year through year-end 2020 (a four-year period).

Complete results of the annual EBRI/ICI 401(k) database update are posted on each organization’s website at www.ebri.org and www.ici.org/research/investors/ebri_ici.