News Release

EBRI/ICI Consistent 401(k) Participant Study Shows Accumulation of Sizable Account Balances

Washington, DC; June 30, 2022—Consistent participants accumulated sizable 401(k) plan account balances between 2010 and 2019, according to a new joint study from ICI and the Employee Benefit Research Institute (EBRI). This study analyzes 401(k) participants who maintained accounts each year from 2010 through 2019. It tracks the account balances of 1.3 million 401(k) plan participants who had accounts in the year-end 2010 EBRI/ICI 401(k) database and each subsequent year through year-end 2019 (a nine-year period).

Key Findings

Analysis of 401(k) plan accounts of the 1.3 million consistent participants in the EBRI/ICI 401(k) database from year-end 2010 to year-end 2019 found:

- The average 401(k) plan account balance for consistent participants rose each year from 2010 through year-end 2019, with the exception of a slight decline in 2018. Overall, the average account balance increased at a compound annual average growth rate of 15.6 percent from 2010 to 2019, rising from $58,658 to $216,690 at year-end 2019.

- The median 401(k) plan account balance for consistent participants increased at a compound annual average growth rate of 18.8 percent over the period, to $108,433 at year-end 2019.

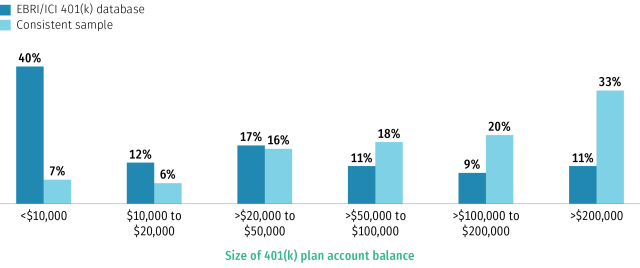

- The growth in 401(k) plan account balances for consistent participants generally exceeded the growth rate for all participants in the EBRI/ICI 401(k) database. By year-end 2019, more than half (53 percent) of the consistent 401(k) plan participants had account balances of more than $100,000, compared with about one-fifth of 401(k) plan participants in the entire EBRI/ICI 401(k) database.

“401(k) plans remain one of the most important avenues toward a secure retirement, and the account growth for consistent 401(k) plan participants highlights the power of this important saving and investing tool,” said Sarah Holden, ICI Senior Director of Retirement and Investor Research.“While markets can be volatile, the compounding growth and upward trends we observed over the nine-year study period shows the benefit of staying the course in their 401(k) plans.”

Consistent 401(k) Plan Participants Tend to Have Accumulated Larger Account Balances

Percentage of 401(k) plan participants with account balances in specified ranges, year-end 2019

Note: Account balances are participant account balances held in 401(k) plans at the participants’ current employers and are net of plan loans. Retirement savings held in plans at previous employers or rolled over into IRAs are not included.

Source: Tabulations from EBRI/ICI Participant-Directed Retirement Plan Data Collection Project

Changes in 401(k) plan account balances are influenced by contributions, asset allocations, withdrawals, and loan activity.

“The significant growth in the 401(k) plan accounts among the younger and new 401(k) participants highlights the importance of contributions and the power of compounding,” said Craig Copeland, Director of Wealth Benefits Research, EBRI. “Younger participants also tend to have higher allocations to equities, often through target date funds, as a result these consistent participants’ balances reflect stock market performance during the study period.”

Other Findings

Other key findings from the report include that younger 401(k) participants or those with smaller year-end 2010 balances experienced higher percent growth in account balances compared with older participants or those with larger year-end 2010 balances. The research also found that these consistent 401(k) participants tend to concentrate their accounts in equity securities. Overall, equities—equity funds, the equity portion of target date funds and other balanced funds, and company stock—represented about two-thirds of their 401(k) plan account assets at both the beginning and end of the study period.

About the Study

The study is based on the EBRI/ICI database of employer-sponsored 401(k) plans, compiled through a collaborative research project undertaken by the two organizations since 1996. The project is unique because it includes data provided by a wide variety of plan recordkeepers and, therefore, represents the activity of participants in 401(k) plans of varying sizes—from very large corporations to small businesses—with a variety of investment options. The 2019 EBRI/ICI database includes statistical information on 11.1 million 401(k) plan participants in 73,312 plans, which hold $0.9 trillion in assets, and covers 18 percent of the universe of active 401(k) participants.

Full results of the annual EBRI/ICI 401(k) database update are posted on each organization’s website, at www.ebri.org and www.ici.org/research/investors/ebri_ici.

Access the study here, What Does Consistent Participation in 401(k) Plans Generate? Changes in 401(k) Plan Account Balances, 2010–2019.