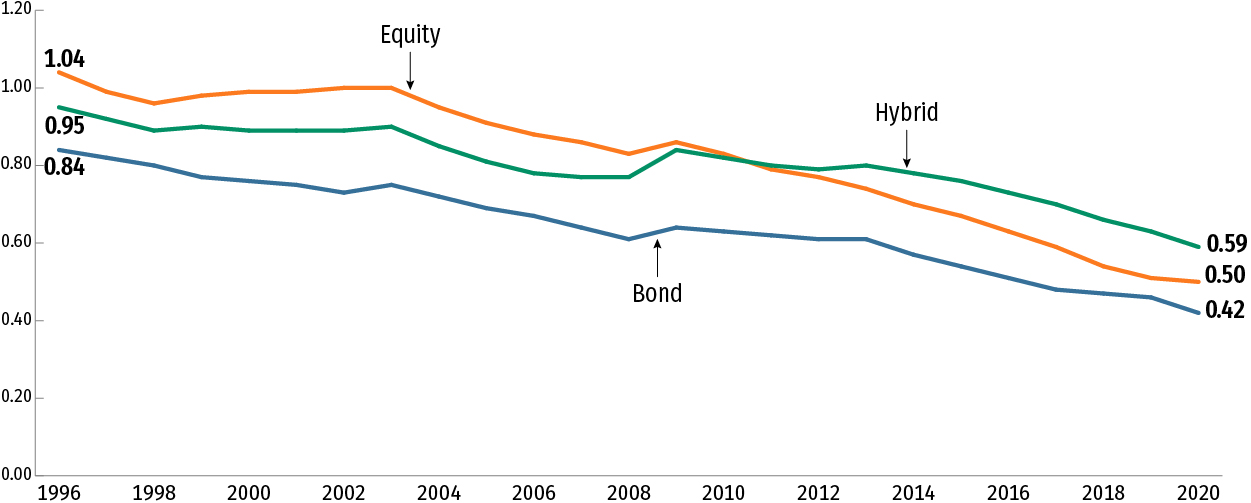

Mutual Fund Expense Ratios Have Declined Substantially over the Past 24 Years

Washington, DC; March 24, 2021—The average expense ratios of equity, hybrid, and bond mutual funds—including both actively managed and index equity and bond mutual funds—have declined substantially over the past 24 years, according to an updated research report from the Investment Company Institute (ICI).

The report, “Trends in the Expenses and Fees of Funds, 2020,” found that equity mutual fund expense ratios averaged 0.50 percent in 2020, compared with 1.04 percent in 1996. Hybrid mutual fund expense ratios averaged 0.95 percent in 1996 and fell to 0.59 percent in 2020; and similarly, bond mutual fund expense ratios averaged 0.84 percent in 1996 and fell to 0.42 percent in 2020. These figures are asset-weighted averages, which reflect the expenses that shareholders actually pay through funds.

“Expense ratios for both actively managed and index mutual funds have declined over the past two decades because fund investing is an extremely competitive marketplace,” said Shelly Antoniewicz, ICI’s senior director of industry and financial analysis. “Investors are seeking new, diverse investment options through funds, and data show they’re very cost conscious, tending to concentrate assets in lower-cost funds when they invest.”

Average Expense Ratios for Long-Term Mutual Funds Have Fallen

Percent

Note: Expense ratios are measured as asset-weighted averages.

Sources: Investment Company Institute, Lipper, and Morningstar

ICI’s report also shows that asset-weighted average expense ratios for both actively managed and index equity mutual funds have fallen from their levels in 1996. In 2020, the average expense ratio of actively managed equity mutual funds was 0.71 percent, down from 0.72 percent in 2019 and 1.08 percent in 1996. Average index equity mutual fund expense ratios also fell over this period. In 2020, average index equity mutual fund expense ratios were 0.06 percent, compared with 0.27 percent in 1996. The report notes that this trend is driven by investor interest in both lower-cost actively managed and index equity mutual funds, as well as asset growth and the resulting economies of scale.

Actively managed and index bond mutual funds have also seen a decline in average expense ratios over the same period. Between 1996 and 2020, the average expense ratio for actively managed bond mutual funds fell from 0.84 percent to 0.50 percent. The average expense ratio for index bond mutual funds fell from 0.20 percent in 1996 to 0.06 percent in 2020 (see Figure 12 in the report).

Inflows to Funds Concentrated in Lower-Cost Funds

Fund investors continued to favor lower-cost funds in 2020, according to the report. For example, the report shows that only actively managed bond and hybrid funds with expense ratios among the lowest 25 percent saw inflows in 2020. While all expense quartiles of index domestic equity funds and index bond and hybrid funds had inflows, the majority of inflows went to funds with expense ratios among the lowest 25 percent (see Figure 17 in the report).

Data for all figures in the report are accessible here.