News and Resources

BrightScope/ICI Data Find That Employer Contributions Are Widespread in 401(k) Plans

Washington, DC; July 15, 2021—Employer contributions are prevalent in 401(k) plans, according to an updated study on 401(k) plans from BrightScope and the Investment Company Institute (ICI). The study, The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2018, found that in 2018, 87 percent of large 401(k) plans (typically those with 100 participants or more, as defined by the Department of Labor [DOL]) covering more than nine out of 10 401(k) participants had employer contributions.

Employers choosing to make contributions to their employees’ 401(k) plan accounts can either match contributions made by the employees or make contributions regardless of employee contributions. One popular way for employers to contribute (used in 51 percent of large 401(k) plans with employer contributions) is with a simple match formula, where employee contributions are matched up to a fixed percentage of salary (for example, the employer matches 50 percent of the employee’s contributions for the first 6 percent of the employee’s salary for a maximum employer contribution of 3 percent of the employee’s salary).

“The employer matching contribution is one of the most important features of the 401(k) system,” said ICI Senior Director of Retirement and Investor Research Sarah Holden. “These contributions help employers provide a competitive benefit option to attract workers and directly support employees in building their retirement nest eggs.”

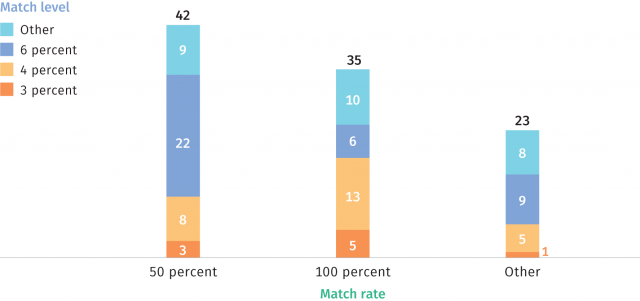

Employers who choose a simple match can customize their formulas by choosing both the percentage of employee contributions to match (the match rate) as well as the percentage of salary to match up to (the match level), and plans offer a variety of match combinations. Among the 51 percent of large 401(k) plans with employer contributions with simple match formulas, the most common formula (used by 22 percent of large 401(k) plans with simple matches) was matching 50 percent of contributions up to 6 percent of employee salary. The next most common simple match formula (used by 13 percent of large 401(k) plans with simple matches), was a dollar-for-dollar (100 percent) match of contributions up to 4 percent of employee salary. Altogether, the most common match rates for employer contributions (with various limits on the maximum employee contribution matched) were 50 percent (used by 42 percent of large 401(k) plans with simple matches) and 100 percent (used by 35 percent of large 401(k) plans with simple matches).

Employers with Simple Matches Use a Variety of Matching Formulas to Encourage Saving

Percentage of plans among large 401(k) plans with a simple match, 2018

Note: Plans with no employer contribution, maximum dollar contributions, tiered match formulas, or only a nonmatching contribution were excluded. The sample is the 50.6 percent of large 401(k) plans with employer contributions that had simple match formulas (see Exhibit 1.7). Form 5500 audited 401(k) filings generally include plans with 100 participants or more.

Source: Investment Company Institute tabulations of US Department of Labor 2018 Form 5500 audited reports

“The data show 401(k) plans are working—as designed—to provide employers with flexibility to customize them to suit the needs of their unique workforces,” said Brooks Herman, executive director of data and research at BrightScope, an Institutional Shareholder Services Inc. business. “Building and offering 401(k) plans with a wide array of features and a full range of investment options encourages employee participation and helps them reach their financial goals.”

Other key findings of the study include:

401(k) plans offer participants a wide variety of investment options. In 2018, the average large 401(k) plan offered 28 investment options, including 13 equity funds, three bond funds, and eight target date funds.

401(k) plan fees trended downward between 2009 and 2018. BrightScope’s total plan cost measure—including all fees on the audited DOL Form 5500 reports, as well as fees paid through investment expense ratios—was 0.94 percent in 2018, down from 1.02 percent in 2009. The study also found that mutual fund expense ratios in 401(k) plans tend to be lower in larger plans and have trended down over time.

Target date fund use has risen over time. In 2018, 84 percent of large 401(k) plans had target date funds in their investment lineups, compared with 32 percent in 2006. The data indicate savers are increasingly using these options; one-quarter of large 401(k) plan assets were invested in target date funds in 2018, compared with 3 percent in 2006.