News Release

ICI Research Finds Americans Remain Committed to Saving for Retirement

Washington, DC; February 10, 2022—Defined contribution (DC) plan participants’ contribution activity remained strong through the first three quarters of 2021 according to ICI’s “Defined Contribution Plan Participants’ Activities, First Three Quarters of 2021.” This ongoing study tracks contributions, withdrawals, and other activity in 401(k) and other DC retirement plans, based on DC plan recordkeeper data covering more than 30 million participant accounts in employer-based DC plans at the end of September 2021.

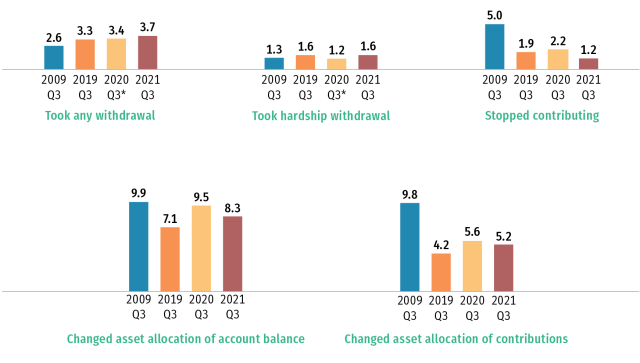

The latest recordkeeper data indicate that plan participants remain committed to saving and investing. Only 1.2 percent of DC plan participants stopped contributing to their plans in the first three quarters of 2021, compared with 2.2 percent in the first three quarters of 2020, and 5.0 percent in the first three quarters of 2009 (another time of financial market stress).

“Despite the economic hardships brought on by the lingering pandemic, the long-term mindset of retirement savers continues to serve them well. Ongoing contributions indicate that most DC plan participants remain committed to saving for their futures, and few withdrawals help to grow and preserve their nest eggs,” said Sarah Holden, ICI senior director of retirement and investor research.

Defined Contribution Plan Participants’ Activities

Summary of recordkeeper data, percentage of participants during the first three quarters of the year indicated

* These withdrawals do not include coronavirus-related distributions (CRDs) identified by the recordkeepers. During the first three quarters of 2020, recordkeepers identified 4.4 percent of DC plan participants taking CRDs. CRDs are no longer allowed in 2021.

Note: The samples include about 24 million DC plan participants for data covering January–September 2009; and more than 30 million DC plan participants for data covering January–September 2019, January–September 2020, and January–September 2021.

Source: ICI Survey of DC Plan Recordkeepers (first three quarters, 2009–2021)

Other findings include:

- DC plan participants mostly stayed the course with their asset allocations as stock values generally rose during the first nine months of 2021. In the first three quarters of 2021, 8.3 percent of DC plan participants changed the asset allocation of their account balances, slightly lower than 9.5 percent in the first three quarters of 2020 and 9.9 percent in the first three quarters of 2009. In the first three quarters of 2021, 5.2 percent changed the asset allocation of their contributions, a bit lower than 5.6 percent in the first three quarters of 2020 and much lower than 9.8 percent in the first three quarters in 2009.

- DC plan withdrawals in the first three quarters of 2021 remained low, but slightly higher than activity observed in recent years. In the first three quarters of 2021, 3.7 percent of DC plan participants took withdrawals, compared with 3.4 percent in the first three quarters of 2020 (as the COVID-19 pandemic hit the United States) and 2.6 percent in the first three quarters of 2009. Levels of hardship withdrawal activity also remained low. Only 1.6 percent of DC plan participants took hardship withdrawals during the first three quarters of 2021, compared with 1.2 percent in the first three quarters of 2020 and 1.3 percent in the first three quarters of 2009. Withdrawal activity likely reflects the impact of ongoing financial stresses relating to the COVID-19 pandemic.

- DC plan participants’ loan activity edged down in the third quarter of 2021. At the end of September 2021, 13.2 percent of DC plan participants had loans outstanding, compared with 13.5 percent at the end of June 2021, and 14.3 percent at the end of March 2021. This downward trend may partly reflect the use of coronavirus-related distributions (CRDs) instead of loans in 2020, as well as an earlier rule change expanding access to hardship withdrawals.

ICI has been tracking DC plan participant activity through recordkeeper surveys since 2008. This update provides results from ICI’s survey of a cross section of recordkeeping firms representing a broad range of DC plans. Please visit ICI’s 401(k) Resource Center for more information.