BrightScope/ICI Data Indicate Plan Sponsors Design 401(k) Plans to Engage Participants

Plan costs also have trended down over time

Washington, DC; August 18, 2020—401(k) plan sponsors typically offer employer contributions, often in combination with the availability of plan loans, to encourage worker participation in the plans, according to an updated study on 401(k) plans from BrightScope and the Investment Company Institute (ICI). The report, The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2017, uses data from the Department of Labor (DOL) Form 5500 and the BrightScope Defined Contribution Plan Database. This update mainly focuses on 2017 data from large 401(k) plans—large plans are typically those with 100 participants or more, as defined by the DOL—that filed detailed audited reports as part of their Form 5500 filing with the DOL.

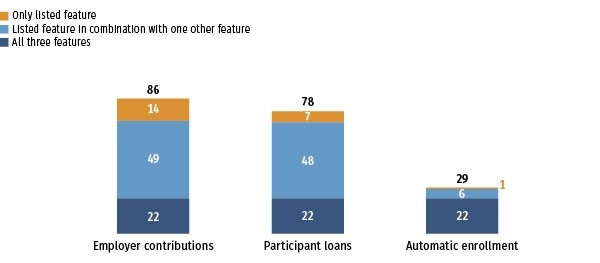

Employer contributions are widespread in these large 401(k) plans: 86 percent of large 401(k) plans, covering 92 percent of large 401(k) plan participants, had employer contributions in 2017. Seventy-eight percent of large 401(k) plans had participants with plan loans; employer contributions and plan loans were the most common combination of plan design features, offered by 46 percent of 401(k) plans. A third feature, automatic enrollment of workers, was offered by 29 percent of large 401(k) plans. More than one-fifth (22 percent) of large 401(k) plans had all three plan design features.

“One of the strengths of the 401(k) system is that it allows employers to customize plans in order to meet the needs of their workforces and encourage employee participation,” said ICI Senior Director of Retirement and Investor Research Sarah Holden. “The flexibility of the plan design allows employers to offer features such as employer contributions, plan loans, auto-enrollment, and diverse investment options, making it easier for participants to plan and save for their futures.”

Plan Sponsors Often Select Combinations of 401(k) Plan Design Features

Percentage of large 401(k) plans

Note: The sample is 60,427 plans with 58.3 million participants and $4.7 trillion in assets. The results include plans that filed Form 5500 Schedule H (typically plans with 100 participants or more) and exclude 403(b) plans with a 401(k) feature. A plan was determined to allow participant loans if any participant had a loan outstanding at the end of plan year 2017.

Source: Investment Company Institute tabulations of US Department of Labor 2017 Form 5500 Research File

401(k) Plans Offer Wide Range of Investment Options

The study found that 401(k) plan sponsors offer a wide and diverse range of investment options to encourage their employees to contribute toward their retirement savings. In 2017, the average large 401(k) plan offered 28 investment options, including a mix of equity funds, bond funds, and target date funds. In 2017, nearly all large 401(k) plans offered domestic and international equity funds, and domestic bond funds; 82 percent of large 401(k) plans offered target date funds; 70 percent offered guaranteed investment contracts (GICs); 64 percent offered other types of balanced funds; 45 percent offered money funds; and 21 percent offered international bond funds.

“Plan sponsors offer participants more than 20 investment options, on average, covering a range of risk and return,” said Brooks Herman, vice president of data and research at BrightScope, an Institutional Shareholder Services Inc. business. “This array of investment choices helps 401(k) participants—whether young and more focused on growth, or older, nearing retirement, and more focused on income—reach their financial goals.”

Other key findings of the study include:

401(k) plan fees trended downward between 2009 and 2017. BrightScope’s total plan cost measure—including all fees on the audited DOL Form 5500 reports, as well as fees paid through investment expense ratios—was 0.92 percent in 2017, down from 1.02 percent in 2009. The study also found that mutual fund expense ratios in 401(k) plans tend to be lower in larger plans and have also trended down over time.

Employer contributions often use matching formulas to encourage employee contributions. In 2017, simple matching formulas were the most common type of employer contribution, as more than half of large 401(k) plans with employer contributions had simple matching formulas.

Target date fund use has risen over time. In 2017, 82 percent of large 401(k) plans had target date funds in their investment lineups, compared with 32 percent in 2006. Nearly one-quarter of large 401(k) plan assets were invested in target date funds in 2017, compared with 3 percent in 2006.