ICI Survey Shows Most Traditional IRA–Owning Households Have Planned Retirement Strategy

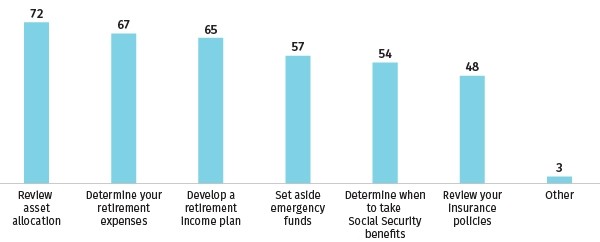

Washington, DC; December 11, 2019—More than two-thirds of US households with traditional individual retirement accounts (IRAs) indicated that they have a strategy for managing their income and assets in retirement, according to an Investment Company Institute (ICI) survey released today. These households’ planning strategies include reviewing asset allocation (72 percent), determining retirement expenses (67 percent), developing a retirement income plan (65 percent), setting aside emergency funds (57 percent), and determining when to take Social Security benefits (54 percent). More than two-thirds of traditional IRA–owning households that indicted they have a strategy took three or more steps in developing it.

The study, “The Role of IRAs in US Households’ Saving for Retirement, 2019,” also found that traditional IRA–owning households sought information from a variety of sources when developing their retirement income and asset management strategy. Among those households with a strategy, 74 percent consulted a professional financial adviser, 24 percent used a website, 24 percent consulted with friends or family, 22 percent consulted a book or article in a magazine or newspaper, and 7 percent used a financial software package.

“Representing one-third of total US retirement market assets, IRAs are a critically important savings vehicle used by more than 46 million American households to prepare for retirement,” said Sarah Holden, ICI’s senior director of retirement and investor research. “ICI data show that traditional IRA–owning households protect their nest eggs by researching and developing strategies to effectively manage their savings and income in retirement.”

Components of Strategy for Managing Income and Assets in Retirement

Percentage of traditional IRA–owning households that indicated they have a strategy for managing income and assets in retirement, 2019

Note: Multiple responses are included; 69 percent of traditional IRA–owning households that indicated they have a strategy for managing income and assets in retirement took three or more steps in developing their strategy.

Source: Investment Company Institute IRA Owners Survey

Traditional IRA Growth Fueled by Rollovers

The study also found that 59 percent of US households with traditional IRAs in mid-2019, or 21 million US households, had accounts that included rollover assets from employer-sponsored retirement plans. Rollovers to IRAs play an important role in allowing retirement savers to keep track of and consolidate their retirement accumulations when changing jobs over the course of their careers. When asked about their most recent rollover, the vast majority (86 percent) of these households reported that they had transferred the entire retirement plan account balance into the traditional IRA, rather than withdrawing any portion of the account. Nearly nine in 10 traditional IRA–owning households with rollovers made their most recent rollover in 2000 or later, including 63 percent who made their most recent rollover since 2010.

Other key findings of the report include:

- More than one-third of US households owned IRAs in mid-2019. More than 60 percent of all US households had either retirement plans through work or IRAs, or both. More than eight in 10 IRA-owning households also had accumulations in employer-sponsored retirement plans.

- More than one-quarter of US households owned traditional IRAs in mid-2019. Traditional IRAs were the most common type of IRA owned (owned by 28.1 percent of US households), followed by Roth IRAs (owned by 19.4 percent) and employer-sponsored IRAs (owned by 6.1 percent).

- Traditional IRA–owning households with rollovers cite multiple reasons for rolling over their retirement plan assets into traditional IRAs. The three most common primary reasons for rolling over were not wanting to leave assets behind at the former employer (25 percent), wanting to preserve the tax treatment of the savings (17 percent), and wanting to consolidate assets (17 percent).

- The majority of traditional IRA withdrawals in tax year 2018 were made by retirees. Eighty-eight percent of households that made traditional IRA withdrawals were retired and only 5 percent of traditional IRA–owning households headed by individuals younger than 59 took withdrawals.

About the Study

“The Role of IRAs in US Households’ Saving for Retirement, 2019” reports information from two separate ICI household surveys. ICI’s IRA Owners Survey, which was conducted in June 2019, is based on a representative sample of 3,228 US households owning traditional IRAs or Roth IRAs. ICI’s Annual Mutual Fund Shareholder Tracking Survey, which was conducted from May to July 2019, is based on a sample of 4,000 randomly selected US households.