Proxy System for Funds Is Costly and Inefficient, New Report Shows

Reforms Are Necessary to Improve System for Funds and Their Investors

Washington, DC; December 23, 2019—The Securities and Exchange Commission (SEC) could save millions of dollars for registered fund shareholders, while ensuring investor protections, by reforming the proxy system that funds must use to gain shareholder approval, according to a new report by the Investment Company Institute (ICI). In a submission filed with the SEC, ICI highlights the findings of a survey on the fund proxy system and the importance of making the system more effective and cost-efficient for funds and their investors.

“ICI’s new report explains how the fund proxy system requires significant resources,” said ICI General Counsel Susan Olson. “Millions of dollars and hours are devoted to a proxy campaign to reach shareholders and obtain their votes. The case for fund proxy reform is strong, and the Commission has the opportunity to improve the system and save fund shareholders millions of dollars.”

The survey analyzed funds’ proxy campaigns over the past seven years. Responses came from 64 firms managing more than $18 trillion, or more than three-fourths of US-registered fund assets.

Obtaining Shareholder Approval by Proxy Is Difficult and Expensive

ICI’s submission builds upon its previous letter to the SEC, emphasizing the challenges funds face in soliciting proxy votes to meet quorum and shareholder approval requirements:

- Funds have a broad and retail-oriented shareholder base

- Current rules limit funds’ abilities to directly contact shareholders

- Retail investors are less likely to vote than institutional investors

Complicating matters further, printed proxy materials are dense and long, so many shareholders do not read them. This forces funds to follow up with mailings, emails, and phone calls in hopes of securing the necessary number of votes.

ICI’s survey reveals that these factors can result in extremely expensive proxy campaigns. For example, respondents provided cost estimates for 145 campaigns for “1940 Act Majority Items,” such as proposed changes to fundamental policies, approvals of advisory and other agreements, and certain mergers. The direct costs of the campaigns totaled more than $373 million, understating overall industrywide costs (pages 2, 8–9). Of those campaigns:

- 22 cost $1 million or more;

- 8 cost $10 million or more;

- 3 cost more than $50 million; and

- the most expensive reported campaign cost $107 million.

ICI’s submission illustrates how the challenges and complexities of the fund proxy system require substantial resources—financial and personnel—and are disproportionately affecting decisions relating to fund policies, governance, and operations (pages 16–21).

ICI’s Supermajority Option Would Substantially Reduce Proxy Campaign Costs

To help make the fund proxy system more efficient and cost-effective, the SEC could make a number of reforms, including allowing an alternative for funds to achieve a “majority vote” for specified items. ICI’s “supermajority recommendation” couples a lower quorum threshold (more than 33 1/3 percent) with a higher affirmative vote (at least 75 percent) to approve certain items (Appendix A).

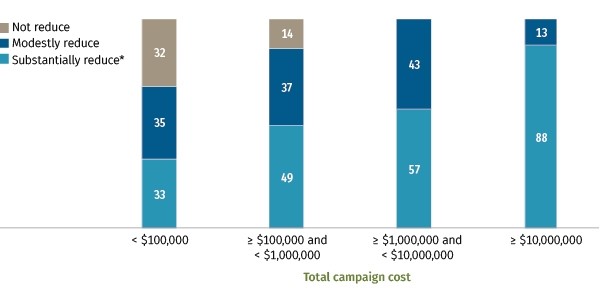

ICI’s report shows that using this approach would meaningfully reduce total costs for 1940 Act Majority Item proxy campaigns—particularly for costlier campaigns. The figure below illustrates that as campaign costs increase, the supermajority method provides more savings for funds and their shareholders. For example, for proxy campaigns that cost $10 million or more, 88 percent of respondents said that the alternative supermajority method would substantially reduce their total proxy campaign costs.

Survey Participants with Costlier Campaigns Reported that ICI’s Supermajority Recommendation Will Substantially Reduce Their Total Proxy Campaign Costs

Percentage of campaigns

*Substantially reduce includes respondents that answered “substantially reduce” or “significantly reduce.”

Note: As noted on page 11 of the report, some proxy campaigns are relatively low-cost because they may be of limited scope and/or the funds’ shareholder bases may have features that significantly reduce the need for follow-up solicitation.

Additional Recommendations

Along with the recommendation for a supermajority approach, ICI explains that even more cost savings could be obtained from other changes to the proxy process (pages 26–27), including:

- creating an alternative way for funds to change fundamental policies or hire sub-advisers without shareholder approval;

- reforming processing fees; and

- allowing funds to link to more detailed information online to make it easier for investors to read and understand proxy materials.