ICI Viewpoints

Inside SID: It’s All About the Rules

Second in a series of ICI Viewpoints posts focusing on how to enhance operational efficiency using existing tools and practices.

One of the benefits of mutual funds is that they can be designed to meet the specific needs of investors’ purchasing preferences. However, this same flexibility to tailor a product can present challenges, because it results in a wide variety of operational rules.

Yet mutual fund processing—trading, paying dividends, calculating net asset value (NAV), etc.—is a rule-driven operation. And the industry’s evolution into an intermediary-distributed model, where omnibus accounts are used, has shifted the application of these rules away from the fund’s transfer agent to intermediary partners: custodians, brokers, dealers, retirement plan administrators, and trust companies. To ensure that shareholders are treated equally, and that all operational and compliance obligations are met, it is essential that fund rules be applied properly, regardless of whether shareholder accounts are held directly by a fund or indirectly by an intermediary.

Help Is Available

The Depository Trust & Clearing Corporation (DTCC) offers several data services to help apply fund rules. This ICI Viewpoints post will focus on reference data in the Security Issue Database (SID) of the DTCC’s Mutual Fund Profile Service II, which contains an immense and dynamic range of critical information. There are more than 26,000 unique fund identifiers in SID, each with 225 data points, totaling more than 5 million pieces of important information, including:

|

|

Working with fund providers, the DTCC has created an effective and efficient process for depositing this monumental amount of data into the repository—and for accessing it. This includes pulling mutual fund prospectus information from the SEC EDGAR database, creating a rule-based routine for comparing profile data to prospectus information, providing workflow tools that enable funds to manage their quality-assurance process, and benchmarking the effectiveness of each fund’s data management.

Operational professionals at intermediaries understand the need to harness and even add to these data to feed their rules-based processes. Beyond the 5 million data points available in the database, an intermediary will need to add other data points (such as selling-agreement provisions, and program restrictions and exceptions) into a data management tool, potentially doubling the size of the data set.

When looking to manage such a large data set, there typically are two alternatives: do it yourself, or hire someone else to do it for you. Either can be the right choice, and many firms do a little of both, but neither is easy. Regardless of the choice, stakeholders need to consider the scope and power of SID as part of a solution.

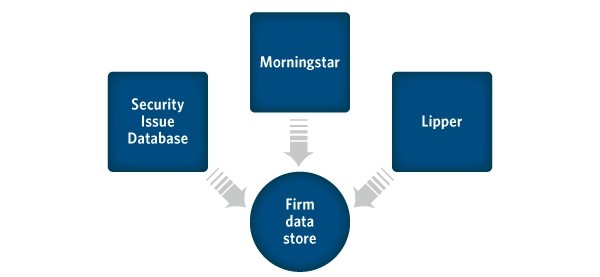

Successful data strategies for “fund security masters” (the main system tables that drive processing) involve the use of multiple sources of fund data. These sources of data can then be tiered into levels, based on an intermediary firm’s comfort level with the data supplied by each source.

In this strategy, the intermediary parses the data by field and source. For example, the “fund name” field could be pulled from a commercial source like Morningstar rather than SID because the Morningstar information is in line with end-client expectations and experience. Information about the “dividend accrual rules” field could be pulled from SID because it’s been provided to SID from the same agent that will pay the dividend, so the firm sees this as a more reliable source.

Information also can be obtained through a lookup tool available as part of DTCC Web Portal Services. Both access points should be part of an intermediary’s data strategy.

As discussed earlier, this process is large and complex—but SID can make things easier. There are times, for example, where an end user at an intermediary might need to confirm a rule on a single fund. Perhaps what is in the security master or internal tool does not square with what the user is seeing happen in the real world, for example, when attempting to verify the sales charge schedule applied to a trade. To verify the fund’s published sales charge schedule, the user can simply use SID rather than searching a prospectus to verify information.

Making It Even Better

As a result of ICI members and intermediary firms working with the DTCC to architect solutions, SID has benefitted from significant improvements in both content and usability over the last 10 years. The industry continues to leverage existing and emerging technology to automate, lower costs, and enhance the shareholder experience. In this drive to a more automated and rule-based environment, SID will become an even more critical data source.

Enhancements and improvements to SID have been driven by the efforts of the ICI Mutual Fund Profile Steering Committee, which includes industry participants and staff from ICI and the DTCC. Guided by industry feedback on how stakeholders are using SID, the steering committee is continuing to assess how the tool can be made more useful to current and future fund distribution activities.

Other Posts in This Series

- Solving for Data Transparency in the Retirement World

- Inside SID: It's All About the Rules

- Practical Use of RPR: Solving Oversight Issues in the Retirement Market

Find Out More

- Contact DTCC Wealth Management at 212-855-8877

- Contact ICI at john.randall@ici.org or jeff.naylor@ici.org

John Randall is director of operations and distribution at ICI.