ICI Viewpoints

ICI Study: Closed-End Fund Assets Were $262 Billion at Year-End 2016

ICI recently released its annual report on the closed-end fund market, which analyzes data on closed-end funds, a type of registered investment company that issues a fixed number of shares that are traded on a stock exchange in the over-the-counter market.

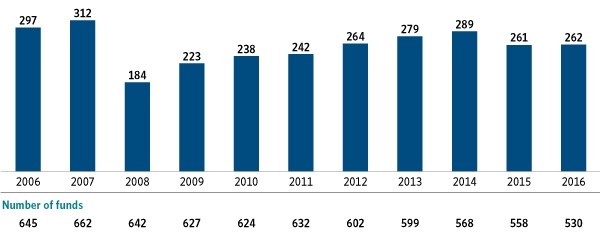

As the report describes, total closed-end fund assets were $262 billion at year-end 2016. This amount is little changed from year-end 2015, as losses from falling municipal bond prices were offset by rising domestic stock prices.

Total Assets of Closed-End Funds Were $262 Billion at Year-End 2016

Billions of dollars; year-end, 2006–2016

Source: Investment Company Institute

The report goes into much more detail on trends in the market, the funds themselves, and the characteristics of their investors, but here are a few key findings:

- The share of assets in bond closed-end funds was 61 percent of all closed-end fund assets at year-end 2016, up only slightly from 59 percent a decade ago. This share has remained relatively stable, as demand for bond closed-end funds has outpaced that of equity closed-end funds.

- Price deviations from net asset values on taxable bond closed-end funds narrowed through most of 2016, reflecting increased investor interest in bonds. The average discount for domestic taxable bond closed-end funds narrowed to 4.7 percent at year-end 2016 from 8.2 percent at year-end 2015.

- Closed-end fund investors tended to have above-average household incomes and financial assets. An estimated 2.8 million US households held closed-end funds in 2016. These households tended to include affluent investors who owned a range of equity and fixed-income investments.

ICI’s Closed-End Fund Resource Center offers this report and more information on closed-end funds—ranging from the basics to the more complex topics—including quarterly closed-end fund data, a guide to closed-end funds, comment letters, and FAQs about their use of leverage.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.