ICI Viewpoints

A 529 Day Primer: Do You Know What State Your College Savings Plans Are In?

You might not know that May 29 is 529 College Savings Day, or even what a Section 529 plan is. But if you’re a parent or grandparent concerned about future college costs, the day presents an opportunity to learn how 529 savings plans can help you plan for—and pay for—your loved ones’ postsecondary education expenses.

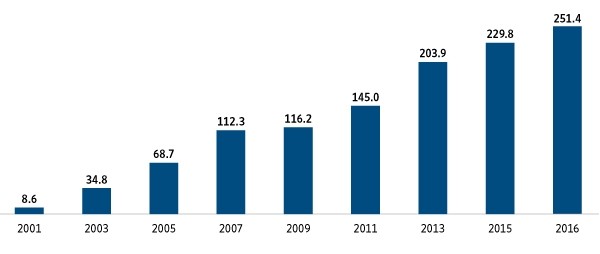

Named for the section of the tax code that provides for their favorable tax treatment, 529 savings plans have become an increasingly popular way to save for college. Assets held in these accounts have grown significantly, from $8.6 billion at the end of 2001 to $251.4 billion at the end of 2016.

Section 529 Savings Plan Assets

Billions of dollars; year-end, selected years

Note: Data were estimated for a few individual state observations in the early years, to construct a continuous time series.

Sources: Investment Company Institute and College Savings Plans Network. See Investment Company Institute, “529 Plan Program Statistics, December 2016.”

What are some of the benefits of a 529 plan? There are quite a few.

529 plans encourage saving by providing a dedicated account for specific goal. ICI research indicates that education savings is a priority for those households most likely to have young children: Data show that mutual fund–owning households headed by younger individuals tend to be more focused on saving for education than households headed by older individuals. But saving for a child’s future education can be challenging for new parents who might be juggling a number of financial priorities at once, including paying off their own student debt, saving for a down payment on a house, and putting money aside for retirement. Setting up a dedicated account—especially one where contributions can be made automatically—makes it easier to plan and save for a specific savings goal.

529 plans provide favorable tax treatment. Nearly all states, as well as Washington, DC, offer 529 savings plans, and make them available to both state residents and nonresidents. If you participate in your state’s 529 savings plan, you may be able to claim a state income-tax deduction on part or all of your contributions. No matter which savings plan you participate in, your earnings grow tax-free, and are free from federal tax when used to pay for qualified education expenses.

529 plans provide control and flexibility. When you open a 529 savings plan, you designate a beneficiary of the plan and select the investment—from among those offered by the plan—in which you’d like your contributions to be invested. Mutual funds are the most common investment vehicle available in 529 savings plans. State plans do vary in the investment options they offer, the fees they charge, and other factors, so you may want to shop around before committing to your own state’s plan.

As the account owner, you can replace the beneficiary with another qualifying family member at any time. So if circumstances change—for example, if your child decides not to pursue higher education or gets a full scholarship—you can transfer benefits to another family member penalty-free.

When it’s time to pay for college expenses, withdrawals from 529 savings plans may be used at virtually all accredited public, nonprofit, and privately owned profit-making postsecondary institutions. To avoid tax penalties, withdrawals must be used to pay for qualified higher education expenses, which include tuition and fees, books, supplies, and other equipment. Even the cost of room and board qualifies if the designated beneficiary is at least a half-time student at an eligible educational institution. Withdrawals used for purposes unrelated to education expenses are subject to tax and a 10 percent penalty on earnings.

You might even score a bargain. Some states offer promotions to celebrate 529 Day and entice you to set up a saving plan—but hurry, because most of these extra incentives expire at the end of May! If you have a little one with big dreams, today’s the perfect time to see if a 529 plan can help.

More about 529 savings plans:

- 529 plan information by state

- ICI’s FAQs and data on 529 plans

- More on education savings programs offered by mutual fund companies

Christina Kilroy is the Vice President of the ICI Education Foundation.