ICI Viewpoints

Models vs. the Real World—Why Bond Funds Aren’t the Bond Market

In two recent blog posts, economists at the Federal Reserve Bank of New York use a theoretical model to assess the size of potential spillover effects from bond mutual fund outflows. Any theoretical model necessarily abstracts from the real world to fit complex problems into manageable thought experiments. The challenge is to make things simpler without departing too far from reality.

Unfortunately, the model used by the New York Fed economists doesn’t meet that test. Instead, it leaves out any discussion of how much bond mutual funds actually hold and trade relative to other market participants, and ignores how other market participants—foreign investors, sovereign wealth funds, pension funds, insurance companies, and others—might react to shocks to the market.

Those omissions matter, because bond mutual funds aren’t nearly as important—either in their share of the bond market or in their share of trading activity—as the model seems to assume. In addition, bond funds have diverse portfolios and their shares are held by millions of investors who are saving for the long term. ICI has made these points in numerous comment letters to the Financial Stability Board, the Financial Stability Oversight Council, and the Securities and Exchange Commission—but it is worth looking at this evidence again.

U.S. Bond Mutual Funds Hold Small Share of U.S. Bond Markets

Assets held by U.S. bond mutual fund assets have risen in the past decade, both in dollar terms and as a share of the market (Figure 1). In fact, U.S. bond mutual assets more than doubled over the past decade, from $1.4 trillion in 2005 to $3.5 trillion by 2015. Even so, bond mutual fund assets were only 10 percent of the U.S. bond market in September 2015, up from 6.7 percent in 2005. This means that 90 percent of the U.S. bond market is held by other investors—investors who are not discussed at all in the Fed blog.

Figure 1

U.S. Bond Mutual Fund Share of U.S. Bond Market

Trillions of U.S. dollars; year-end, 2005–2015*

*Data are as of September 30, 2015.

Note: Bond mutual fund total net assets include assets of U.S.-registered open-end mutual funds whose investment objectives are to invest primarily in debt securities. Data exclude assets in exchange-traded funds (ETFs) and money market funds, and mutual funds that invest primarily in other mutual funds.

Sources: Investment Company Institute and Federal Reserve Board

What about less-liquid segments of the bond market, though? Maybe things are different if, for instance, we focus only on high-yield bond funds.

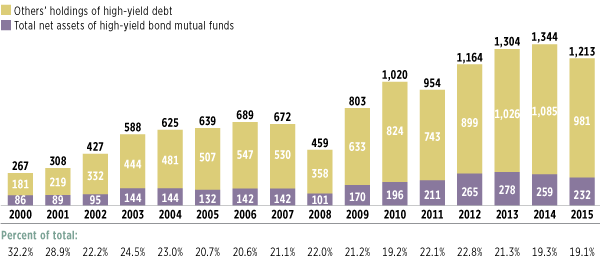

U.S. High-Yield Mutual Funds Hold About One-Fifth of the U.S. High-Yield Bond Market

It is true that the U.S. high-yield bond mutual funds hold a larger share of the high-yield market: about 19 percent in 2015, down from 20.7 percent in 2005 (Figure 2). Rather than the rising share we saw in the overall bond market, funds’ share of the high-yield market has not changed much in the past 10 years, fluctuating between 19 and 23 percent. This ratio still means that more than three-quarters of high-yield bonds are held by other investors.

Figure 2

High-Yield Bond Mutual Funds’ Share of Outstanding High-Yield Bonds

Billions of dollars; year-end, 2000–2015

Note: Data exclude high-yield funds designated as floating-rate funds. Outstanding high-yield bonds are measured as the market value of the bonds in the Bank of America–Merrill Lynch US High-Yield Index. Data also exclude ETFs and funds that invest primarily in other funds.

Sources: Investment Company Institute and Bloomberg

U.S. High-Yield Bond Mutual Funds Trade Less Than Other Market Participants

Conjectures about large outflows from bond mutual funds often assume that other investors are inert or simply do not exist. In reality, other investors buy and sell bonds regularly, among themselves and with bond funds. In fact, data from the Financial Industry Regulatory Authority (FINRA) and ICI suggest that those other investors actually trade more than bond mutual funds. Although high-yield bond mutual funds hold 19 percent of the total market value of high-yield bonds, they recently have accounted for only about 10 percent of the trading volume in high-yield bonds (Figure 3).

Figure 3

U.S. High-Yield Mutual Funds’ Corporate Bond Trading as a Share of All High-Yield Transactions

Percentage; monthly, July 2014–December 2015

Note: Data exclude high-yield funds designated as floating-rate funds. Aggregate data for high-yield 144A transactions are only publicly available starting July 2014.

Sources: Investment Company Institute and FINRA TRACE

The Importance of Proper Perspective

Analyses suggesting that bond mutual funds might pose systemic risks often overlook or minimize key characteristics. Here, we have highlighted one such characteristic: these funds constitute only a fraction of the bond market, and an even smaller portion of bond market trading. If, in the real world, bond trading drives bond prices, it would seem appropriate to look at bond trades for all market participants, not just those of bond mutual funds—which, in the case of high-yield bonds, amount to only one-tenth of the trading volume in that market segment.

Chris Plantier is a senior economist in ICI’s Research Department.

Sean Collins is Chief Economist at ICI.