ICI Viewpoints

New Research by New York Fed Confirms: Bond Funds Don’t Pose Systemic Risks

In a series of recent blog posts, economists at the Federal Reserve Bank of New York discussed results from a theoretical model assessing the potential for bond mutual funds to pose systemic risks. These economists posit that a downturn in the bond market might lead to large-scale redemptions from bond funds (“runs”), in turn causing bond funds to sell their holdings into an already declining market (“fire sales”), potentially putting further downward pressure on bond prices (“spillover effects”).

In one post (“Quantifying Potential Spillovers from Runs on High-Yield Funds”), the economists focus on the potential for these kinds of risks to arise in less-liquid bond funds, in particular high-yield bond funds—a source of much discussion among regulators. To make the assessment, the New York Fed economists assume massive outflows from high-yield bond funds—aggregate outflows many times larger than ever seen in history, even during periods of very significant market stress, such as the recent Great Recession. But even with this very extreme assumption, the spillover effects are minimal, costing investors at most 23 basis points (0.23 percent) of fund assets. These spillovers are so small that they are likely have little, if any, effect on investors’ decisions. They certainly are not the stuff of systemic risks.

(These results shouldn’t be surprising: mutual funds aren’t the dominant players in the bond market. Bond mutual funds own only about 10 percent of outstanding bonds, and conduct an even smaller share of trading. We’ll discuss that in an upcoming ICI Viewpoints.)

How Do the New York Fed Economists Assess Systemic Risks?

The Fed economists’ work is based on a theoretical model. They have created equations that they assume describe how much investors will redeem from bond funds if bond prices decline. They also have created equations positing what share of their portfolios bond funds would sell to meet such redemptions, as well as equations that hypothetically show the impact of those resulting bond sales on bond prices in general.

For these equations to work, though, they must make a number of assumptions. One key assumption: precisely how strongly will investors redeem out of bond funds if the bond market declines? This is important, because if the bond market declines but investors redeem only moderately, the large spillovers that the economists are searching for won’t actually arise.

Do the Data Support the Fed’s Assumptions?

The Fed’s scenario about high-yield fund flows makes an extreme assumption: namely, that all high-yield bond funds will experience outflows of 50 percent of their assets—apparently instantaneously.

Just how extreme is this? It’s extreme. In fact, it’s not much of a stretch to say it’s extremely extreme. We have indicated many times that bond fund investors redeem only modestly, even in the face of the very largest market declines. There’s simply no historical precedent for the type of outflows that the Fed model assumes.

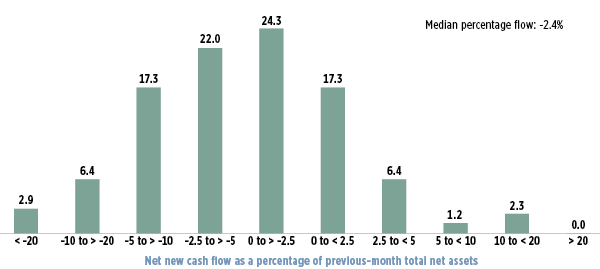

The Fed blog focuses on developments in high-yield bond funds in December 2015, a month roiled by the news that one high-yield fund—Third Avenue Capital’s Focused Credit Fund—had suspended redemptions following months of large outflows. The figure below shows, however, that even in the face of those events, outflows from individual high-yield funds were quite modest. In December 2015, the median high-yield fund experienced outflows of just 2.4 percent of its assets. And no high-yield fund had outflows of 50 percent of its assets—a far cry from the Fed’s assumptions.

In short, the Fed’s model assumes all high-yield funds will experience outflows of 50 percent; in the actual episode of market stress, none of those funds came close.

Typical High-Yield Bond Mutual Funds Experienced Only Moderate Outflows

Distribution of monthly flows as a percentage of total number of funds, December 31, 2015

Note: Data exclude mutual funds that invest in other mutual funds, funds specifically designed for frequent trading, funds designated as floating-rate funds, funds without a full year of history, and any fund with a merger between November 1, 2015, and December 31, 2015.

Note: Components may not add to the total because of rounding.

Source: Investment Company Institute

Even the Fed’s Extreme Model Suggests Spillovers Are Minimal

So the Fed’s economists built a model intended to assess whether outflows from bond fund can create systemic risks (such as spillover effects), and then assumed extreme outflows from high-yield bond funds. What happened?

Very little. Their model indicates that total spillovers to all of the bonds held by U.S. open-end mutual funds would total $9 billion dollars. That is the hypothetical extra return lost to investors if all high-yield funds experience instantaneous outflows of 50 percent and the rest of the Fed’s model is also correct.

Now, $9 billion is nothing to sneeze at. But relative to the assets of U.S. open-end mutual funds, a $9 billion move would be almost lost in the noise of daily market activity. Consider, for example, that taxable (nongovernment) bond mutual funds and hybrid mutual funds (which hold a mix of stock and bonds) totaled $3.89 trillion in December. Thus, the Fed’s hypothetical estimated spillover losses of $9 billion would amount to 23 basis points (0.23 percent) of these funds’ assets. If one includes the assets of all long-term taxable mutual funds, which totaled $12.304 trillion in December 2015, the effect amounts to just 7 basis points (0.07 percent) of those funds’ assets.

To put these figures in context, returns on medium- to long-term Treasury bonds in 2015 varied by about 41 basis points (0.41 percent) per day, as measured by the standard deviation of daily returns on the Barclays 7-10 Year Treasury market total return index. Thus, the size of the shock created by the Fed’s model—even with its extreme assumptions—is less than the swing in Treasury bond returns on a typical trading day.

Fed’s Research Suggests That Outflows from Bond Funds Don’t Pose Systemic Risks

In other words, the New York Federal Reserve’s own research suggests that even extremely large outflows from bond funds—assumed outflows far greater than any ever seen in history—simply don’t pose systemic risks. The Fed economists themselves seem to agree, noting that “in this set of funds, no particular fund seems capable—by virtue of its size or asset holdings—to impose significant large fire-sale spillovers on its own.” We think that their research actually points to a stronger conclusion: outflows from all bond funds in aggregate don’t seem capable of imposing the kinds of hypothetical fire-sale and spillover risks that the New York Fed’s research discusses.

Chris Plantier is a senior economist in ICI’s Research Department.

Sean Collins is Chief Economist at ICI.