ICI Viewpoints

Once Again, Information Moves Markets

Treasury yields fell sharply today and the stock market jumped. Wouldn’t it be nice if mutual funds could take credit? Unfortunately, they can’t. Any orders that mutual fund investors place to buy or sell shares anytime today before 4:00 p.m. won’t hit the market until 4:00 p.m., just like any other day. And, if you are reading this blog post at the time of its posting, 4:00 p.m. is still 10 minutes away.

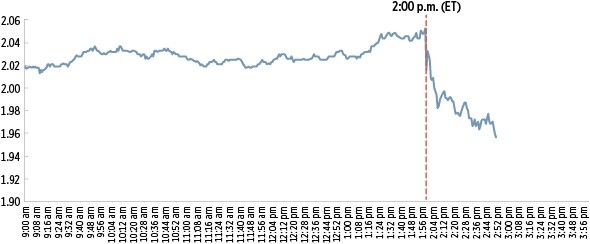

Instead, the sharp changes in the market occurred right at 2:00 p.m. (ET) (see chart) when the Federal Reserve released the minutes of its March Federal Open Market Committee (FOMC) meeting, which indicated that it would be unlikely to raise interest rates at its upcoming April meeting.

Yield on 10-Year U.S. Treasury, March 18, 2015

Percent; minute-by-minute

Source: Bloomberg

This shows that new information moves the market. I emphasize this point because if things had gone the other way today—if the Fed had indicated tightening and markets had dropped—sure as the sun will shine, some commentators would have incorrectly attributed the drop to shareholders redeeming out of funds—even though that couldn’t possibly be the case because their orders aren’t executed until 4:00 p.m.

Sean Collins is Chief Economist at ICI.