ICI Viewpoints

Small Savers at a Loss

As ICI has pointed out before, the proposed rule from the Department of Labor (DOL) to redefine what counts as a fiduciary relationship in the retirement market is fundamentally flawed. But it is no less flawed than the DOL’s justification for it—a Regulatory Impact Analysis that fails to demonstrate a market failure that supports the need for such a sweeping and costly rule.

Perhaps the most glaring weakness in the analysis is its failure to account for the loss of advice, guidance, and services that individual retirement account (IRA) investors would suffer should the rule be implemented as proposed—help that they depend on to reach their retirement savings goals.

Because the rule would place onerous restrictions on brokers and other commission-based advisers, and prompt many of them to exit the marketplace, IRA investors hoping to retain access to financial advice would be forced to turn to fee-based advisers. Those who do would likely pay more in fees.

But not all IRA investors would have that option. Those with lower account balances would be unable to meet fee-based advisers’ minimum-balance requirement (often $100,000). That means many IRA investors could be shut out of investment information entirely. More than three-quarters of individual traditional IRAs hold less than $100,000 today.

Not to worry, the DOL says. In a recently published Q&A, it writes that more than two-thirds of small-IRA owners—which it defines as holders of IRAs with balances of less than $25,000—are “wealthy and upper-middle-class households for whom these IRAs generally represent only a single component of a larger financial portfolio.” These households, the Q&A states, “generally own their own homes as well as other types of financial assets such as job-based defined-contribution plans, stocks, and mutual funds.”

The implied conclusion is that, by adding other parts of “a larger financial portfolio,” most owners of IRAs with low balances would be able to meet fee-based advisers’ $100,000 minimum—and so retain access to vital investment information. But this is just another DOL conclusion that doesn’t stand up against the evidence.

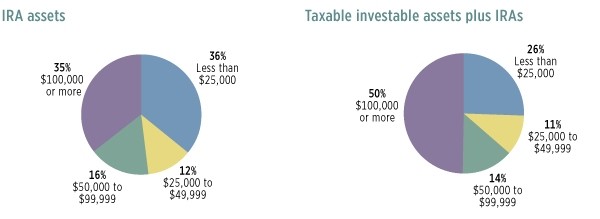

As the figure below shows, 64 percent of households with IRAs—almost two-thirds—have total balances of less than $100,000, even when combining all the traditional and Roth accounts in the household. And even after including taxable investable assets that IRA investors could bring to a financial adviser, half of IRA-owning households still would be unable to meet the typical $100,000 minimum.

Household Holdings of IRAs and Taxable Investable Assets

Percentage of IRA-owning households, by amount of assets, 2013

Note: IRAs include traditional and Roth IRA assets held by the household. Components do not add to 100 percent because of rounding.

Source: Investment Company Institute tabulation of Federal Reserve Board 2013 Survey of Consumer Finances

This finding is not that surprising. Except among the very wealthiest households, home equity and job-based retirement assets make up most of household net worth—and, of course, neither of those can be invested with a fee-based adviser.

No matter how you look at the data, the overarching finding is clear. The DOL’s proposed rule would cut millions of IRA investors off from the brokers and other commission-based advisers they depend on for retirement investment information—and cost these investors $109 billion in added fees and lower returns over its first 10 years.

The wealthiest households might still be able to obtain investment information through fee-based advisers—and absorb the added expense that doing so would entail. Lower-income families, on the other hand, wouldn’t be so lucky.

Brian Reid is ICI’s chief economist.

Sarah Holden is ICI’s senior director of retirement and investor research.

Brian Reid was Chief Economist of the Investment Company Institute.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.