ICI Viewpoints

Designation’s Vast Reach into Investor Portfolios

On Wednesday, March 25, I’ll testify before the Senate Committee on Banking, Housing, and Urban Affairs about the Financial Stability Oversight Council’s process for designating nonbank firms as “systemically important financial institutions,” or SIFIs.

As ICI has said repeatedly in public commentary, SIFI designation would be inappropriate and harmful for regulated funds and their investors. Regulated funds or asset managers designated as SIFIs would be subject to bank-level capital requirements, the risk of assessments to pay into a resolution fund for any failed SIFI bank, and Federal Reserve supervision—including “prudential oversight.”

What does “prudential oversight” mean? In a recent speech, Fed Governor Daniel K. Tarullo called for “prudential market regulation” to provide a “system-wide perspective” that would trump traditional investor protections and market regulation, and respond to “system-wide demands.” Presumably, any fund or manager designated a SIFI henceforward would be put to the service of two masters—with the Fed’s focus on protecting banks and other institutions trumping the interests of fund shareholders saving for retirement, education, homeownership, or other financial goals. We don’t think investors would fare well in that plan.

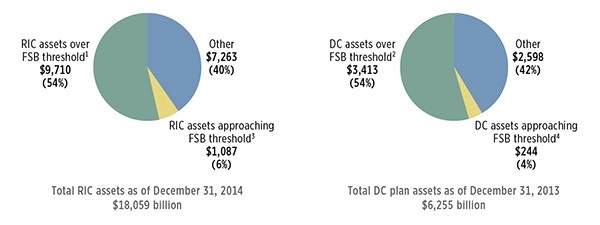

That Fed oversight could reach far into investors’ portfolios. In fact, more than half of the assets in mutual funds, exchange-traded funds (ETFs), and other registered investment companies—as well as more than half of the retirement savings in 401(k) and other defined contribution (DC) plans—could fall directly or indirectly under the Fed’s prudential oversight, with all the added costs and potential controls over investing that such oversight would bring.

Under FSB Proposal, Federal Reserve Would Be “Prudential Market Regulator” for More Than Half of the U.S. Regulated Fund and Defined Contribution (DC) Plan Markets

Billions of dollars

1Represents registered investment company (RIC) assets managed by asset managers with more than $1 trillion in assets under management (AUM) globally, or RIC assets managed by asset managers with at least one regulated fund with net assets exceeding $100 billion.

2Represents defined contribution (DC) assets managed by asset managers with more than $1 trillion in AUM globally, or DC assets managed by asset managers with at least one regulated fund with net assets exceeding $100 billion.

3Represents RIC assets managed by asset managers with more than $750 billion in AUM globally.

4Represents DC assets managed by asset managers with more than $750 billion in AUM globally.

Note: Components may not add to the total because of rounding.

Sources: Investment Company Institute and Pensions and Investments

How do we reach this conclusion?

The Fed is one of the U.S. representatives to the Financial Stability Board (FSB)—an international body of central bankers and other financial regulators. An FSB project, led by Governor Tarullo, is working to figure out which funds and asset managers should be reviewed for potential designation as global SIFIs (G-SIFIs). In its latest proposal, the FSB sets out size-based thresholds for identifying the asset managers and individual funds that automatically would be evaluated for potential designation as G-SIFIs. Under one scenario, any asset manager with more than $1 trillion of assets under management worldwide or any individual fund with more than $100 billion in assets would be considered for designation.

As the charts above show, if these thresholds were applied to the U.S. regulated fund industry, and the funds and managers meeting the thresholds were designated as SIFIs, a staggering share of the assets managed by funds and included in DC retirement plans could be swept under Federal Reserve oversight. Of the $18.1 trillion that investors have in U.S. regulated funds, more than $9.7 trillion could come under Fed supervision. Of the $6.3 trillion in DC plans—savings that millions of workers have set aside for retirement—more than $3.4 trillion could come under such supervision.

Did Congress intend for the Dodd-Frank Act to give the Federal Reserve such broad prudential oversight of U.S. regulated funds? Did Congress even imagine that this was possible? We highly doubt it—but we hope Congress will now take note.

Paul Schott Stevens was President and CEO of ICI.