ICI Viewpoints

Securities Lending by Mutual Funds, ETFs, and Closed-End Funds: The Market

Second in a series of Viewpoints on securities lending

As the potential risks of securities lending are discussed and debated by the Financial Stability Oversight Council (FSOC), the U.S. Treasury’s Office of Financial Research (OFR), and the Financial Stability Board (FSB), it is important to try to understand both the overall size of the securities lending market and the share of it attributable to different participants.

As we’ll explain in this post—the second in our series on securities lending—it appears that mutual funds, exchange traded funds (ETFs), and closed-end funds that are registered under the Investment Company Act of 1940 (which we’ll call U.S. regulated funds) have a smaller share of the securities lending market than some of the discourse on securities lending might suggest.

How Big Is the Securities Lending Market?

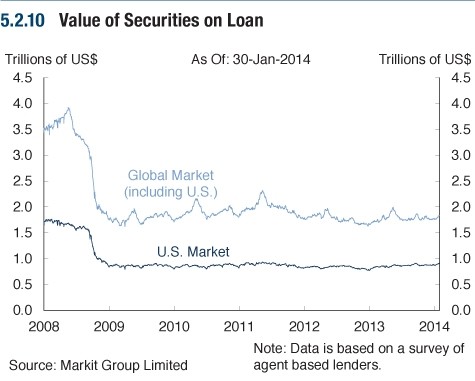

The honest answer is, we don’t really know. As the FSOC, OFR, and FSB have pointed out, there are gaps in the publicly available data on securities lending. That said, several firms have estimated the size of the lending market based on data from participating lending agents (custodian banks and other institutions that facilitate securities lending). Citing statistics from one of those firms, the FSOC’s annual report pegs the average daily value of securities lending transactions at $1.8 trillion worldwide, with the value of U.S. securities on loan at about half that total—approximately $900 billion. Here’s the relevant chart from the FSOC annual report.

Though we have no way of confirming these figures, they seem consistent with other estimates of the size of the global and U.S. securities lending markets.

How Big a Role Do U.S. Regulated Funds Play?

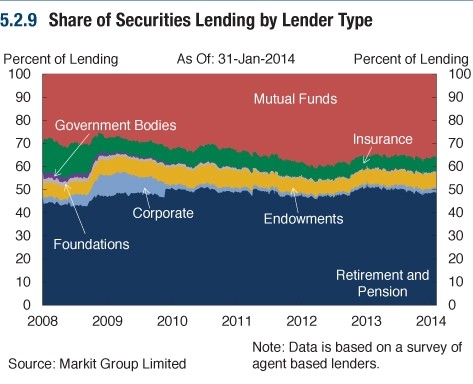

The FSOC suggests that “mutual funds” account for around 35 percent of securities lending, as shown in the chart below from its annual report.

The FSOC does not provide details about the chart and what is included within the “mutual funds” category, but we assume that the category includes U.S. regulated funds (mutual funds, ETFs, and closed-end funds) and similar non-U.S. funds. The FSOC also does not provide details on the denominator it used to calculate the percentage of lending, although again, we assume that it uses the value of the global market for securities on loan from its chart 5.2.10 shown above.

Based on these assumptions, the 35 percent figure seems high. As we explained in our first post, securities lending is a relatively minor strategy for most U.S. regulated funds, due in large part to strict regulation of the practice by the Securities and Exchange Commission (SEC). Among other restrictions, the SEC prohibits U.S. regulated funds from lending more than one-third of their total assets. In practice, as you’ll see below, U.S. regulated funds generally lend far less.

The FSOC’s 35 percent figure also seems high in comparison with statistics cited by the OFR. In its 2013 report on the asset management industry, the OFR included a pie chart that pegged the share of securities lending by “mutual funds” at 18 percent. Though the FSOC doesn’t offer any explanation for the difference, one reason might be that the OFR appears to have been working with a different denominator. It included categories of lenders that are not in the FSOC’s chart—such as central banks, which account for 13 percent of lenders in the OFR pie chart. (Although to be fair, we are equally unsure of what went into the OFR’s statistic. Like the FSOC, the OFR does not provide any explanation of the underlying data reflected in its pie chart.)

Spurred on by the FSOC’s chart and 35 percent statistic, ICI looked at the most recent financial statements for the 500 largest U.S. regulated funds (excluding money market funds, which are not likely to lend securities). These 500 U.S. regulated funds represent about $9.62 trillion in total assets, which is more than two-thirds of the total assets of all long-term U.S. regulated funds. Here’s what we found:

- Collectively, the 500 funds had $95.1 billion in securities on loan—an amount equal to 0.99 percent of their total assets.

- Not all of these funds engage in securities lending. In fact, only 37.6 percent—188 of the 500—had any securities on loan.

- These 188 funds, managing about $4.17 trillion in total assets, collectively had 2.28 percent of their total assets on loan.

- Of the 188 funds that lend, most—156, or 83 percent—had less than 5 percent of their assets on loan. Twenty others (10.6 percent) had between 5 percent and 10 percent of their assets on loan, while only 12 (6.4 percent) had more than 10 percent of their assets on loan.

- Of the 188 funds that lend, most—148, or 78.7 percent—were equity funds. These 148 equity funds had $75.4 billion of securities on loan.

- The index funds and ETFs in our data set of 500 funds were more likely to lend securities than the other types of funds that lend. There were 86 index funds and ETFs in our data set, and 65 of them—or 75.6 percent of the group of 86—had securities on loan. These 65 funds and ETFs accounted for $51.6 billion of the securities on loan, more than half of the $95.1 billion total lent by the 188 funds that had any securities on loan.

For comparison, we also compiled data on the securities lending activity of the 10 largest state and local public employee defined benefit (DB) pension funds, based on their 2013 financial reports. These funds, with $1.37 trillion in total assets, had $92.96 billion in securities on loan—or 6.8 percent of their assets. All of these pension funds engaged in securities lending, with levels ranging from 1.54 percent of their total assets to 15.47 percent.

How Do the Different Estimates Compare?

The FSOC’s two charts, taken together, suggest that “mutual funds” worldwide have approximately $630 billion in securities on loan (35 percent of $1.8 trillion on loan globally).

The 500 funds in our data set had $95.1 billion in securities on loan—or just more than 5 percent of the $1.8 trillion on loan globally. The $9.62 trillion in total assets held by these 500 funds account for more than two-thirds of the total assets of all long-term U.S. regulated funds, and about 30 percent of all long-term regulated fund assets worldwide.

Based on this limited data set, we cannot definitively say that the FSOC overstates the amount of securities lending conducted by “mutual funds,” although it’s hard to see how you could get to $630 billion based on what we found about the level of securities lending activity by the largest U.S. funds. What’s not hard to see, however, is that regulators need to take a very close look at their data as they consider the risks of securities lending.

Next Up—Major Concerns

So far we’ve taken a look at the “what,” “how,” and “how much” of securities lending. In tomorrow’s post, we’ll explore some of the concerns over securities lending identified by the FSOC, OFR, and FSB.

Read the other entries in this Viewpoints series:

- Securities Lending by Mutual Funds, ETFs, and Closed-End Funds: The Basics

- Securities Lending by Mutual Funds, ETFs, and Closed-End Funds: The Market

- Securities Lending by Mutual Funds, ETFs, and Closed-End Funds: Regulators' Concerns

- Securities Lending by Mutual Funds, ETFs, and Closed-End Funds: Are the Risks Systemic?

Bob Grohowski is a senior counsel at ICI.

Sean Collins is Chief Economist at ICI.