ICI Viewpoints

Living Wills and an Orderly Resolution Mechanism? A Poor Fit for Mutual Funds and Their Managers

During the global financial crisis, the distress or disorderly failure of some large, complex, highly leveraged financial institutions (banks, insurance companies, and investment banks) required direct intervention by governments—including a number of bailouts—to stem the damage and prevent it from spreading. One focus of postcrisis reform efforts has been to ensure that regulators are better equipped to “resolve” a failing institution in a way that minimizes risks to the broader financial system, as well as costs to taxpayers. The new tools provided under the Dodd-Frank Act include requirements for the largest bank holding companies and nonbank systemically important financial institutions (SIFIs) to prepare comprehensive resolution plans in advance (known as “living wills”), and creation of a new “orderly resolution” mechanism for financial institutions whose default could threaten financial stability.

But funds do not “fail” in the way that banks do. Unlike banks, funds don’t guarantee investors a rate of return, or even a return of principal. All investment results—gains and losses, no matter how big or small—belong to the fund’s investors on a pro rata basis. If a fund doubles in value, it is the investors who reap the rewards. And if the fund plunges in value, it is the investors who absorb the losses, with no risk to the financial system at large. Investors know this going in—and share that expectation with the broader marketplace.

This post—a summary of a longer paper examining this issue—discusses why living wills and an orderly resolution mechanism are unnecessary for mutual funds and the firms that sponsor or manage them, focusing on three points:

- Funds and fund managers exit the business routinely, in an orderly way.

- The structure and regulation of funds, along with the competitive dynamics of the fund industry, help facilitate these orderly exits.

- Funds and managers have exit strategies that can be executed within the existing regulatory framework.

Fund and Manager Exits Are Routine and Orderly, Even in Stressed Markets

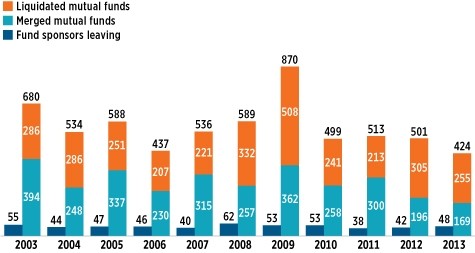

Mutual funds merge and liquidate routinely. In the United States, 424 mutual funds were merged or liquidated in 2013 alone (see figure below). One common reason for liquidating a fund or merging it with another is the inability of a fund to attract or maintain sufficient assets, often because of poor investment performance. If a fund fails to attract sufficient assets over time, and does not attain certain economies of scale, it ultimately will not be viable from a business perspective. Further, its expenses will be spread over a smaller asset base, leading to higher expenses for fund shareholders and impairing its ability to compete.

Fund managers also exit the business on a routine basis—for example, a fund manager could exit if it failed to attract or maintain sufficient assets under management or if its parent company went bankrupt. As the figure shows, 48 managers exited in 2013.

When funds and managers exit the business, they do so in an orderly fashion. Even in periods of severe market stress, fund and manager exits do not create disorder that broadly affects the investing public, market participants, or financial markets—and there remains a healthy market of interested acquirers for funds, fund assets, and management firms. For example, global merger and acquisition volume across the asset management industry totaled $4 trillion in 2009, double the $2 trillion in 2008.

U.S. Mutual Funds and Mutual Fund Sponsors Routinely Exit the U.S. Mutual Fund Market

View a larger version, including data from 1996 to 2013

Note: Data for the number of mutual funds that were merged or liquidated include funds of funds and exclude exchange-traded funds and closed-end funds. Data for the number of fund sponsors leaving before 2000 are unavailable.

Fund Structure and Regulation—and Industry Competitive Dynamics—Facilitate Exits

Several features of the structure and regulation of mutual funds help facilitate the orderly resolution of these funds and their managers:

- First, each mutual fund is a separate legal entity, distinct from its manager and from other funds in the same fund complex. A fund typically has no employees of its own; instead, fund operations are carried out by service providers, including the fund manager (also called the investment adviser).

- Second, the Investment Company Act of 1940 requires mutual funds to maintain strict custody of fund assets separate from the assets of the fund manager, using an eligible custodian (typically a U.S. bank).

- Third, the fund manager does not take on the risks inherent in the securities or other assets it manages for a fund—the fund and its shareholders bear those risks. The fund manager manages the fund’s portfolio as an agent under a written contract with the fund, in accordance with the fund’s investment objectives and policies as described in the fund’s prospectus.

- Finally, mutual funds are required by statute to have a board of directors (or trustees) that oversees the fund’s management, operations, and investment performance. Members of these boards are largely independent—as of year-end 2012, independent directors made up three-quarters of boards in 85 percent of fund complexes. Board responsibilities include annually reviewing and approving (including by a majority of the independent directors) the fund’s investment advisory contract, and overseeing the services that the fund manager provides under that contract.

The fund industry’s competitive nature also facilitates exits. The mutual fund business is very dynamic, with more than 800 mutual fund sponsors in the United States in 2013, and the industry’s long-standing competitive environment has prevented any one firm or group of firms from dominating the market. For example, of the largest 25 fund complexes in 2000, only 13 remained in this top group in 2013.

The competition and lack of concentration in the industry demonstrate that fund managers are highly “substitutable”—meaning that the government would not need to support the activities or survival of any one manager. Individual funds likewise are highly substitutable. More than 100 mutual funds typically operate in each investment category—in many cases, several hundred do. Fund sponsors generally offer funds in many categories, and investors can move their investments easily from one fund to another without disrupting the market.

Finally, fund managers have a very strong incentive to acquire assets under management to achieve greater economies of scale. Though the manager does not own the assets of its funds and other clients, its contracts to manage those funds and the accounts of other clients are considered valuable “assets” of the manager. In any situation where a fund manager decided or was forced to leave the business, other fund managers (or other financial institutions) would likely bid for their business.

Exit Strategies Can Be Executed Under the Existing Regulatory Framework

Existing laws and regulations, along with industry dynamics, allow both funds and managers to exit the business in a number of ways.

Funds—Liquidation, Merger, or Transfer of Management Contract. When a mutual fund does need to liquidate, there is an established and orderly process by which the fund liquidates its assets, distributes the proceeds pro rata to investors, and winds up its affairs—all without consequence to the larger financial system. This process adheres to requirements in the Investment Company Act and state laws, including consideration and approval by the mutual fund’s board of directors.

Mergers also follow established processes under law and regulation. For example, a merger involving affiliated funds would be conducted in accordance with Rule 17a-8 under the Investment Company Act, which seeks to ensure that the transaction is in the best interests of the shareholders of each fund. Fund boards play a critical role in evaluating and approving the terms of any merger, consistent with their fiduciary obligations to the fund and its shareholders.

In the vast majority of cases, a fund merger or liquidation is not compelled by unusual circumstances, so the process can proceed at a pace that the fund manager and fund board deem appropriate. But in the face of extreme market conditions or other extraordinary circumstances, the fund manager and fund board have the ability to act swiftly.

Even in times of severe market stress, funds—particularly stock and bond funds—generally are able to satisfy investor redemptions without adverse impact on the fund’s portfolio and the broader marketplace. That said, if a fund were to face a “perfect storm” of unusually heavy redemption pressures and difficult market conditions, the Securities and Exchange Commission (SEC) would be able to invoke its authority under Section 22(e) of the Investment Company Act to protect the fund’s shareholders by allowing a fund to suspend redemptions temporarily. The need for such relief is rare.

A fund board also has the authority to terminate a fund’s contract with its manager and engage a new manager, without undue disruption to the fund and its shareholders. If necessary, this can be done quickly on an interim basis, subject to later shareholder approval.

Fund Managers—Sale, Merger, or (Highly Unlikely) Resolution. Because of the dynamic nature of the fund industry, a likely exit strategy for a fund manager would be to find a buyer for its business. Sale or merger of a fund business may happen for a variety of “routine” business reasons, or may be prompted by financial difficulty of the fund manager. If there were a problem with an entity affiliated with the fund manager (such as bankruptcy of the manager’s parent company), there likely would be a sale or spin-off of the advisory business.

We are unaware of any notable fund manager filing for bankruptcy. If a fund manager did ever face a solvency problem, the fund board could exercise its authority to terminate the fund’s contract with the manager, as discussed above.

If a fund manager did need to go through resolution, the process would be very straightforward. The manager’s own assets typically would be limited to such items as real estate, and telecommunication, computer, and office equipment. The manager might possibly own shares in the funds it previously managed, but those shares would be treated just like shares held by other investors. Liabilities typically would be limited to such things as leases, service contracts (covering such areas as investment research, pricing vendors, and legal and accounting services), and routine personnel expenses. Fund assets would remain with the fund custodian.

Regulators Have the Tools They Need

Distress, disorderly failure, and taxpayer bailouts have little to do with mutual funds or asset management in general. All three concerns stem directly from experience with “too big to fail” banks and other financial institutions, so it’s no surprise that the tools designed to address these concerns do, too. Living wills and an orderly resolution mechanism may have a place, but they seek to mitigate risks that mutual funds and their managers do not pose. For mutual funds and their managers, regulators already have the tools they need.

Frances Stadler is a senior counsel for securities regulation at ICI.

Rachel Graham is a senior associate counsel at ICI.

Frances Stadler was a senior counsel for securities regulation at ICI.

Rachel Graham is Associate General Counsel & Corporate Secretary at ICI.