ICI Viewpoints

Americans Support Their 401(k)s

Fifth in a series of Viewpoints postings on key facts about the 401(k) and the American retirement system

It’s pretty obvious to anyone who reads ICI Viewpoints that we believe 401(k) plans are a successful part of an overall retirement system that is working for working—and retired!—Americans. But we’re far from the only ones who think so. Surveys show that Americans share this confidence in the 401(k) and support the key features of 401(k)s and other defined contribution (DC) plans.

At the end of 2012, Americans had set aside $5.1 trillion in all employer-based DC retirement plans—more than one-quarter of assets earmarked for retirement and nearly 10 percent of households’ total financial assets—with $3.6 trillion held in 401(k) plans. So on the most basic level, savers are showing their support of 401(k)s by their actions, paycheck by paycheck.

Americans Support and Value the 401(k)

That commitment was tested during the worst financial crisis since the Great Depression. Even in the depths of the crisis, Americans continued to trust in the 401(k)’s ability to help them meet their retirement goals. And they haven’t wavered since, as demonstrated in our quarterly monitoring of about 24 million participant accounts and annual surveys of 3,000 or more households.

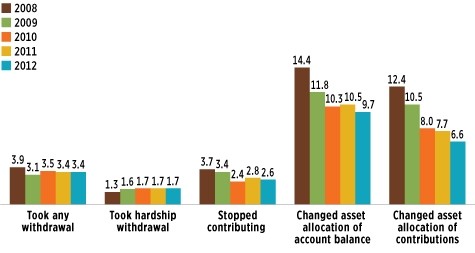

From 2008 right through our 2012 survey, participants have shown a remarkable commitment to stay the course. The number of savers who quit contributing never exceeded 3.7 percent, and in 2012 only 2.6 percent stopped contributing. Even during the crisis, only about one in seven switched the asset allocation of their account balances.

Defined Contribution Plan Participants’ Activities

Summary of recordkeeper data; percentage of participants

Note: The samples include more than 22 million DC plan participants in 2008 and nearly 24 million DC plan participants in 2009–2012.

Source: ICI Survey of DC Plan Recordkeepers (2008–2012)

The 2012/2013 household study also highlights households’ confidence that the 401(k) plan will help them meet their retirement goals. In each survey since 2009, about three-quarters of all households have expressed confidence that DC plans can help provide for retirement. DC plan owners also expressed appreciation of the basic features of this form of retirement saving, including the opportunities for individual choice in investing, the ability to defer taxes on savings, personal control of retirement assets, and the ability to save automatically paycheck by paycheck. These results were also consistent through the 2008 downturn and since, with little variation in responses among age and income groups.

Americans Support Current Tax Incentives for 401(k)s

Americans’ attitudes toward the tax features of DC plans are particularly positive. It is resoundingly clear that Americans believe the current tax incentives for 401(k)s should be preserved. More than 80 percent of DC-owning households said that the immediate tax savings from their retirement plans were a big incentive for them to contribute. In addition, 85 percent of households agreed that the tax incentives of DC plans should not be removed. These results were consistent through the 2008 downturn and since. This support resounds even among households that did not have a retirement account—in 2012/2013, 81 percent of such households opposed eliminating the incentives.

Americans also support retaining current employer and employee contribution levels to 401(k) accounts. Eighty-two percent of all households opposed reducing the contribution limits for individuals, while 79 percent opposed reducing the amount that employers can contribute to the accounts of their employees.

What to Remember

Americans value the convenience, discipline, and investment opportunities that 401(k) and other participant-directed retirement plans represent. They also value the tax incentives in these plans. The next time you read a criticism of the 401(k) plan or support for an alternative, remember that the overwhelming majority of Americans don’t share that view. Simply put, Americans believe their 401(k)s are working for them.

Data and research show that their faith is not misplaced. If used correctly, 401(k)s and other DC plans, when combined with the other elements that make up America’s retirement system, can help form the basis for a comfortable retirement. Those concerned about the future of retirement in this country should listen to 401(k) savers when they express their support for this key component of American retirement security.

***

For more key information on retirement, please visit our Retirement Resource Center or read the previous entries in this Viewpoints series:

Mike McNamee is ICI's chief public communications officer.