ICI Viewpoints

IRA Rollovers Serve Investors Well

The U.S. Department of Labor (DOL) is preparing to reintroduce its controversial proposal to revise the long-standing definition of “fiduciary” under the Employee Retirement Income Security Act (ERISA). Lawmakers from both sides of the aisle in Congress have said that this proposal actually could reduce retirement savers’ ability to obtain needed investment information from financial services firms. Despite these doubts, some critics now seem to be arguing that a new fiduciary definition is not enough. Instead, they suggest that there is a need for new laws to limit workers’ ability to roll over assets from a 401(k) to an individual retirement account (IRA) when they leave a job or retire.

For example, the authors of “Will Regulations to Reduce IRA Fees Work?” advocate not just restrictions on rollovers but also limits on the investment options that can be held in IRAs or 401(k) plans. The authors contend that the potential for risk rises with higher levels of personal choice, and suggest that ordinary investors cannot necessarily be trusted to make the right choices. Ultimately, the authors say, “It makes no sense to expose the average participant to these options.”

Yet decades of data about IRAs and 401(k) plans and their use demonstrate that retirement investors manage their assets well and value the personal choice they enjoy in these plans. These data show that IRA investors benefit from the opportunity to:

- Consolidate 401(k) accounts from multiple employers into one IRA, which is a convenient way to preserve tax benefits and simplify asset management. Indeed, ICI research shows that the prime driver of IRA growth is the rollover of assets from employer-sponsored retirement plans (defined benefit and defined contribution) to IRAs when participants leave a job or retire.

- Manage their IRAs based on advice that they receive from a financial professional, from their own research, or both.

- Choose from a wide range of providers and investment options, including actively managed funds, index funds, exchange-traded funds (ETFs), individual stocks, and bonds.

- Receive these benefits at a cost that—at least for mutual funds, which make up the largest component of IRA assets—has fallen by almost 30 percent during the past two decades.

Participants Are Making Appropriate Choices

IRAs account for the largest share of the country’s retirement savings. The $5.4 trillion in these accounts made up more than one-quarter of U.S. retirement assets at the end of 2012, with 40 percent of U.S. households owning at least one type of IRA.

ICI’s most recent annual survey of households owning IRAs found that preserving the tax treatment of retirement savings was the motivation for two-thirds of those with traditional IRAs who rolled 401(k) funds over to an IRA. Almost half of those surveyed said that the convenience of consolidating assets was part of their reason for the rollover.

The survey also showed that most IRA investors are acting thoughtfully and carefully with their assets. Almost 70 percent of traditional IRA owners say they have a planned retirement strategy; more than 60 percent of these traditional IRA–owning households with a strategy said that they had consulted a professional financial adviser as their primary source in creating this strategy. Others said they had consulted with friends or family, written materials, or websites.

Mutual Fund Assets Are Concentrated in Lower-Cost Funds

The authors of the paper claim that rollovers from 401(k) plans to IRAs are problematic because “IRAs tend to be invested in mutual funds with higher fees.” But the data show that just as the overall mutual fund sector has seen expenses fall steadily over the past 20 years, IRAs—where assets managed by mutual funds account for 46 percent of the market—have seen expenses fall, as investors tend to concentrate their assets in lower-cost funds.

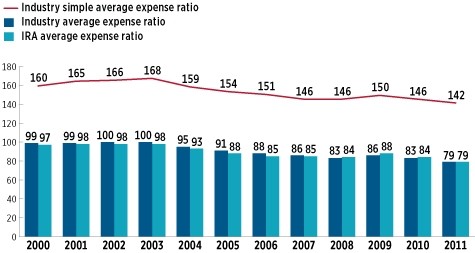

For example, over the past two decades, average expenses paid by mutual fund investors on an asset-weighted basis have fallen significantly. In 1993, equity fund investors on average incurred expenses of 107 basis points, or $1.07 for every $100 in assets. In 2012, expenses averaged 77 basis points for equity fund investors—nearly 30 percent lower. The figure below, which shows data from 2000 to 2011, demonstrates that IRA expenses have closely tracked trends in the overall mutual fund sector.

IRA Mutual Fund Investors Tend to Pay Expenses Similar to Industry Expenses

Equity funds, basis points, 2000–2011

Note: Data exclude mutual funds available as investment choices in variable annuities and mutual funds that invest primarily in other mutual funds. Figure reports year-end asset-weighted average of annual expense ratios for individual funds.

Sources: Investment Company Institute and Lipper

The paper’s authors also claim that “the average individual who rolls over his 401(k) plan into an IRA enters a world in which broker-dealers face incentives to sell high-fee investments.” Yet ICI data show that investors in mutual funds tend to concentrate assets in lower-cost options. As of year-end 2011, the 25 percent of equity funds with the lowest expense ratios managed 72 percent of total net assets—while equity funds with expenses in the top three quartiles held only 28 percent of total net assets. A similar pattern holds for actively managed equity funds, equity index funds, and target date funds.

A Competitive Market Provides Many Choices

As part of their recommendations to reduce fees, the paper’s authors suggest an “ambitious reform” that would “limit investment options to low-cost index funds for 401(k)s” and possibly “for rollover IRAs as well.” However, plan sponsors already generally select a lineup of investment options to cover a range of risk and return, and DC account–owning households indicate that they like the investment lineup in their plans and the investment control. A recent ICI survey, “America’s Commitment to Retirement Security: Investor Attitudes and Actions, 2013,” shows that 96 percent of such households agreed with the statement: “It is important to have choice in and control of the investments in my retirement plan account.” Similarly, 93 percent of respondents agreed with the statement: “Retirees should be able to make their own decisions about how to manage their own retirement assets and income.” This overwhelmingly positive response did not vary much across the population when the sample was split by age, income, or whether the household did or did not own defined contribution accounts or IRAs.

Participants in 401(k) plans have a wide range of choice among investment options—choice that helps educate them and drive their decisionmaking process as they roll these assets into IRAs. Such participants are well acquainted with index funds as part of the fund universe. For example, according to the 55th Annual Survey by the Plan Sponsor Council of America (PSCA), which reviewed the 2011 activities of 840 plans representing 10.3 million participants and $753 billion in assets, employers offer an average of 19 funds to employees, while more than 82 percent of employer plans offer a domestic equity index fund. Both the employers who sponsor plans and the fund advisers who help manage them believe that participants benefit from a range of investment options.

The opportunity to roll 401(k) account assets into an IRA benefits investors. The combination of employer plans and IRAs have helped Americans accumulate $19.5 trillion in retirement assets and manage those assets for greater retirement security. The strengths of these accounts, combined with Social Security, is amply documented in ICI’s recent paper, The Success of the U.S. Retirement System. IRAs are working, and working well, as part of a multilayered system of savings that helps Americans prepare for retirement.

David Abbey is senior counsel for pension regulation at ICI.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.