ICI Viewpoints

FTT Would Shut Financial Institutions in Participating Countries Out of Repo Market

The European Commission has proposed imposing a 0.1 percent (10 basis points) levy on financial transactions. As ICI has detailed, this financial transaction tax (FTT) would have a host of negative consequences, including harm to investors and extraterritoriality.

Here’s another strike against the proposal: its impact on the market for repurchase agreements (repo).

Proponents claim that the proposed tax—0.1 percent of the value of repo transactions involving financial institutions from the 11 countries that have signed on in support of the proposed tax—would hardly affect market participants. But the opposite is true. For example, the FTT would be felt acutely by investors (including U.S. money market funds) conducting repo transactions in which financial institutions from those 11 countries were counterparties. Thus, the tax likely would work to eliminate repo as a source of funding to affected financial institutions, particularly French and German banks.

Background on Repurchase Agreements

Repos are a form of short-term funding used largely by financial institutions such as banks. The financial institution sells the securities to investors, such as a money market fund, usually on an overnight basis, and agrees to buy them back at a higher price reflecting the cost of funding.

European FTT Would Weigh Heavily on Repo Yields

The FTT would create a substantial drag on repo yields for investors conducting repo transactions with affected financial institutions. In fact, it would produce negative net yields on repo—both in the current low interest rate environment and at more normal interest rate levels for shorter duration repo.

The proper measure of the burden of the tax is not the tax rate on assets involved in a single repo transaction, but the effect the tax has on the net yield of covered repo holdings. Depending on the maturity, the cumulative annual tax on covered repo holdings would be 5 percent to 25 percent. In other words, annual repo yields would need to rise above at least 5 percent for investors to receive a positive net yield on repo “covered” or captured by the FTT. Even for covered repos with longer maturities, investors would be hard-pressed to justify an investment and would look elsewhere to find higher after-tax returns.

Cumulative Effect of FTT on Repo

The burden that transaction taxes place on investors would depend on the amount and maturity of covered repos held in their portfolios. The shorter the maturity of the covered repo, the higher the cumulative annual tax rate would be, because the tax would be paid each time the investor renewed (rolled over) the repo. Figure 1 illustrates the multiplicative effect of this “small” 10 basis point tax.

For example, at year-end 2012, U.S. money market funds held $139 billion in covered repo, all with financial institutions in Germany and France. Repos tend to have short maturities, and 95 percent of covered repo held by U.S. money market funds had a remaining maturity of seven days or less. If the $139 billion in covered repo had a seven-day maturity and covered repo holdings were not reduced in response to the tax, this dollar amount would be rolled over 52 times in a year and would cost a little more than $7 billion in taxes. In this case, the cumulative annual tax would represent 518 basis points (5.2 percent) of covered holding, not 10 basis points (0.1 percent). As the maturity of the covered repo shortens up, the cumulative annual tax rises dramatically. If all covered repo were overnight, the U.S. money market fund industry would pay nearly $35 billion in taxes annually, or 2,503 basis points (25 percent) of their covered holdings.

Figure 1

Tax Rises Quickly as Maturity of Repo Declines

| Covered repo1 Billions |

Maturity Days |

Implied annual turnover | Tax rate Basis points |

Cumulative annual tax3 Billions |

Cumulative annual tax rate4 Basis points |

| $139 | 7 | 52 | 10 | $7.2 | 518 |

| 139 | 5 | 73 | 10 | 10.1 | 726 |

| 136 | 3 | 122 | 10 | 16.9 | 1,215 |

| 139 | 1 | 2502 | 10 | 34.8 | 2,503 |

1Source: ICI tabulations of Form N-MFP data as of December 31, 2012.

2Accounts for weekends and holidays.

3Calculated as covered repo multiplied by implied annual turnover multiplied by (tax rate/10,000).

4Calculated as (cumulative annual tax/covered repo) multiplied by 10,000.

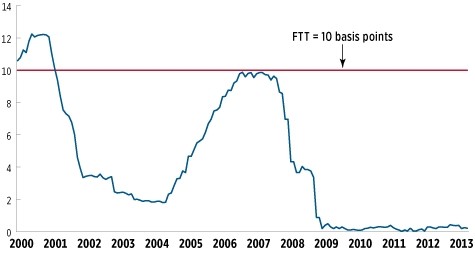

Likely Outcome of FTT: Investors Shift and a Loss of a Funding Source

The proposed tax on repo holdings would represent a substantial burden in any interest rate environment, but certainly would eliminate repo between investors in the short-term markets and financial institutions in the 11 participating countries given current yields. At the end of March, a seven-day repo collateralized with U.S. Treasury securities yielded just 0.2 basis points, substantially below the 10 basis point proposed tax for this transaction (Figure 2). To compensate for the tax, financial institutions in the 11 countries, including French and German banks, would need to pay about 50 times as much for seven-day repo funding at current yields.

Figure 2

Yields* on Seven-Day Repo Too Low to Support European Commission FTT

Basis points, month-end, January 2000–March 2013

*Represents yield received for one repo transaction over a seven-day period; not expressed at an annual rate.

Source: Bloomberg

A more likely outcome is that investors, including U.S. money market funds, would shift to assets with equivalent risk but higher after-tax returns. Banks in the 11 countries with the FTT would lose repo as source of funding; the effect of the “small” FTT would be enormous.

Learn more about FTTs at our resource center.

Shelly Antoniewicz is the Deputy Chief Economist at ICI.

Peter Brady is a Senior Economic Adviser at ICI.