ICI Viewpoints

Mind the Gap

It’s a good idea to “mind the gap” if you’re traveling on the Tube in London, taking Amtrak in the United States, or riding Metro in Paris or Washington, DC. Being mindful of the space between where you are and where you’re going is important—not only when navigating public transit, but also when saving for retirement.

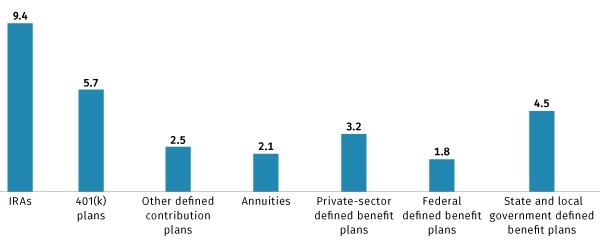

Saving for retirement is a career-long process, with many decisions along the way, including how much to save, how to invest, how long to work, when to retire, and when to claim Social Security. To complement Social Security, which provides an important foundation for nearly all American workers, Americans have more than $29 trillion earmarked for retirement (see figure below). Ongoing contributions continually add more to that nest egg—about $400 billion a year into 401(k) plans alone—but the question each saver asks is: am I doing enough?

US Retirement Assets Top $29 Trillion

Trillions of dollars, 2019:Q1

Source: Investment Company Institute, Quarterly Retirement Market Data

The good news is that there are many resources available to help you assess if you’re on track to reach your retirement goals. If you have a 401(k) or other workplace retirement plan, your plan likely provides access to a retirement assessment tool such as a retirement gap calculator, an income projection tool, or a projected monthly income estimate on your account statement.

These valuable tools help retirement savers think about and plan for their future, but savers agree that the retirement plans themselves also help. According to an ICI survey, nine in 10 defined contribution (DC) account–owning individuals appreciate that their employer-sponsored retirement account helps them to think about the long term, not just their current needs.

If you don’t have access to a workplace retirement plan or if you need assistance beyond what your plan sponsor provides, these resources may also be helpful:

- If you’re looking for general guidance in estimating how much to save each year to reach your retirement goals, check out the retirement calculators from FINRA and the US Department of Labor.

- If you’re saving for retirement through an individual retirement account (IRA), your financial services provider may have a calculator on its website.

- And, if your household works with a financial adviser, he or she can also help with this exercise.

Whatever tool you use, be sure to mind the gap. By making small adjustments to your savings habits now instead of more dramatic changes closer to retirement, you can let compound returns do the heavy lifting—and you can better enjoy the ride.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Christina Kilroy is the Vice President of the ICI Education Foundation.